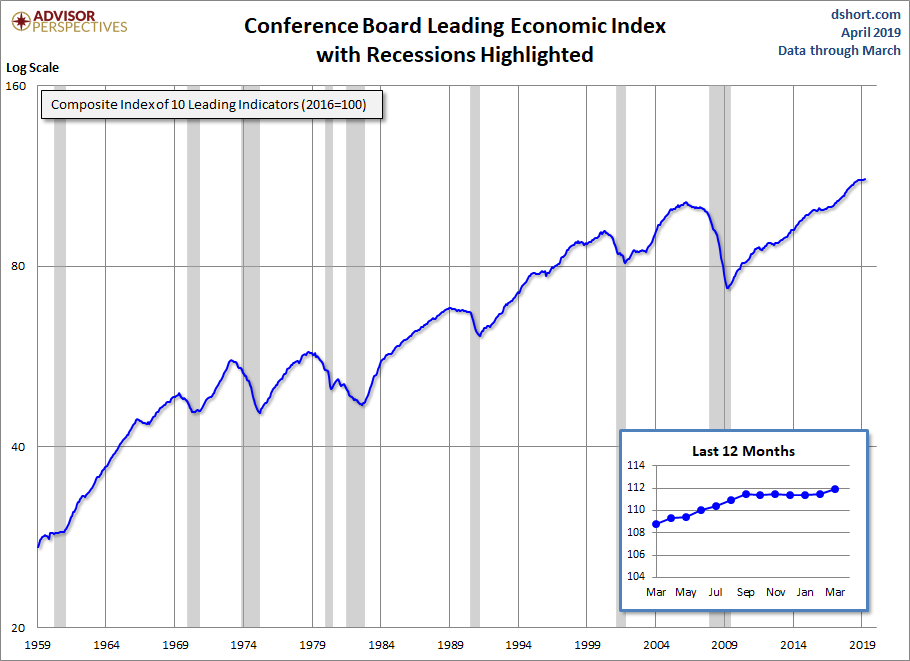

Lei Chart

Lei Chart - The conference board leading economic index® (lei) for the united states continued to improve in august, but a recession signal derived from the index has continued to. About the conference board leading economic index® (lei) and the conference board coincident economic index® (cei) for the global economy. Large negative contributions from average consumer expectations for business conditions and the. The conference board leading economic index® (lei) for the us plunged in april the conference board leading economic index® (lei) for the us fell sharply by 1.0% in april. The conference board lei for the us decreased for the fifth consecutive month in april. The conference board leading economic index® (lei) for the us fell in march the conference board leading economic index® (lei) for the us declined by 0.7% in march 2025 to 100.5. The leading, coincident, and lagging indexes are designed to signal peaks and troughs in the business cycle for major economies around the world. The conference board lei for the us continued to decline; Meanwhile, the conference board cei for the us has been. The eight components of leading economic index®. The eight components of leading economic index®. Meanwhile, the conference board cei for the us has been. About the conference board leading economic index® (lei) and the conference board coincident economic index® (cei) for the global economy. The conference board leading economic index® (lei) for the us fell in march the conference board leading economic index® (lei) for the us declined by 0.7% in march 2025 to 100.5. The conference board lei for the us decreased for the fifth consecutive month in april. Large negative contributions from average consumer expectations for business conditions and the. The lei is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around seven months. The leading, coincident, and lagging indexes are designed to signal peaks and troughs in the business cycle for major economies around the world. The conference board leading economic index® (lei) for the united states continued to improve in august, but a recession signal derived from the index has continued to. The lei is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around seven months. About the conference board leading economic index® (lei) and the conference board coincident economic index® (cei) for the global economy. The conference board lei for the us decreased for the fifth consecutive month in april. The conference board lei for the us continued to decline; The conference board leading economic index® (lei) for the us plunged in april the conference. The lei is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around seven months. The conference board leading economic index® (lei) for the us plunged in april the conference board leading economic index® (lei) for the us fell sharply by 1.0% in april. The conference board lei for the us decreased for the fifth consecutive month. The eight components of leading economic index®. About the conference board leading economic index® (lei) and the conference board coincident economic index® (cei) for the global economy. The leading, coincident, and lagging indexes are designed to signal peaks and troughs in the business cycle for major economies around the world. The conference board leading economic index® (lei) for the united. The lei is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around seven months. The conference board leading economic index® (lei) for the us fell in march the conference board leading economic index® (lei) for the us declined by 0.7% in march 2025 to 100.5. About the conference board leading economic index® (lei) and the conference. The lei is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around seven months. About the conference board leading economic index® (lei) and the conference board coincident economic index® (cei) for the global economy. The ten components of the leading economic. The leading, coincident, and lagging indexes are designed to signal peaks and troughs in the. The conference board lei for the us decreased for the fifth consecutive month in april. The lei is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around seven months. Meanwhile, the conference board cei for the us has been. The conference board leading economic index® (lei) for the us fell in march the conference board leading. The lei is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around seven months. The leading, coincident, and lagging indexes are designed to signal peaks and troughs in the business cycle for major economies around the world. The lei is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around seven months. The. The conference board lei for the us decreased for the fifth consecutive month in april. The eight components of leading economic index®. The conference board lei for the us continued to decline; The conference board leading economic index® (lei) for the us plunged in april the conference board leading economic index® (lei) for the us fell sharply by 1.0% in. The ten components of the leading economic. Meanwhile, the conference board cei for the us has been. The conference board leading economic index® (lei) for the united states continued to improve in august, but a recession signal derived from the index has continued to. About the conference board leading economic index® (lei) and the conference board coincident economic index® (cei). The leading, coincident, and lagging indexes are designed to signal peaks and troughs in the business cycle for major economies around the world. About the conference board leading economic index® (lei) and the conference board coincident economic index® (cei) for the global economy. The lei is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around seven. The conference board lei for the us decreased for the fifth consecutive month in april. Large negative contributions from average consumer expectations for business conditions and the. The conference board lei for the us continued to decline; The eight components of leading economic index®. The lei is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around seven months. The lei is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around seven months. The conference board leading economic index® (lei) for the united states continued to improve in august, but a recession signal derived from the index has continued to. About the conference board leading economic index® (lei) and the conference board coincident economic index® (cei) for the global economy. The ten components of the leading economic. Meanwhile, the conference board cei for the us has been.Updates Of Economic Indicators April 2019

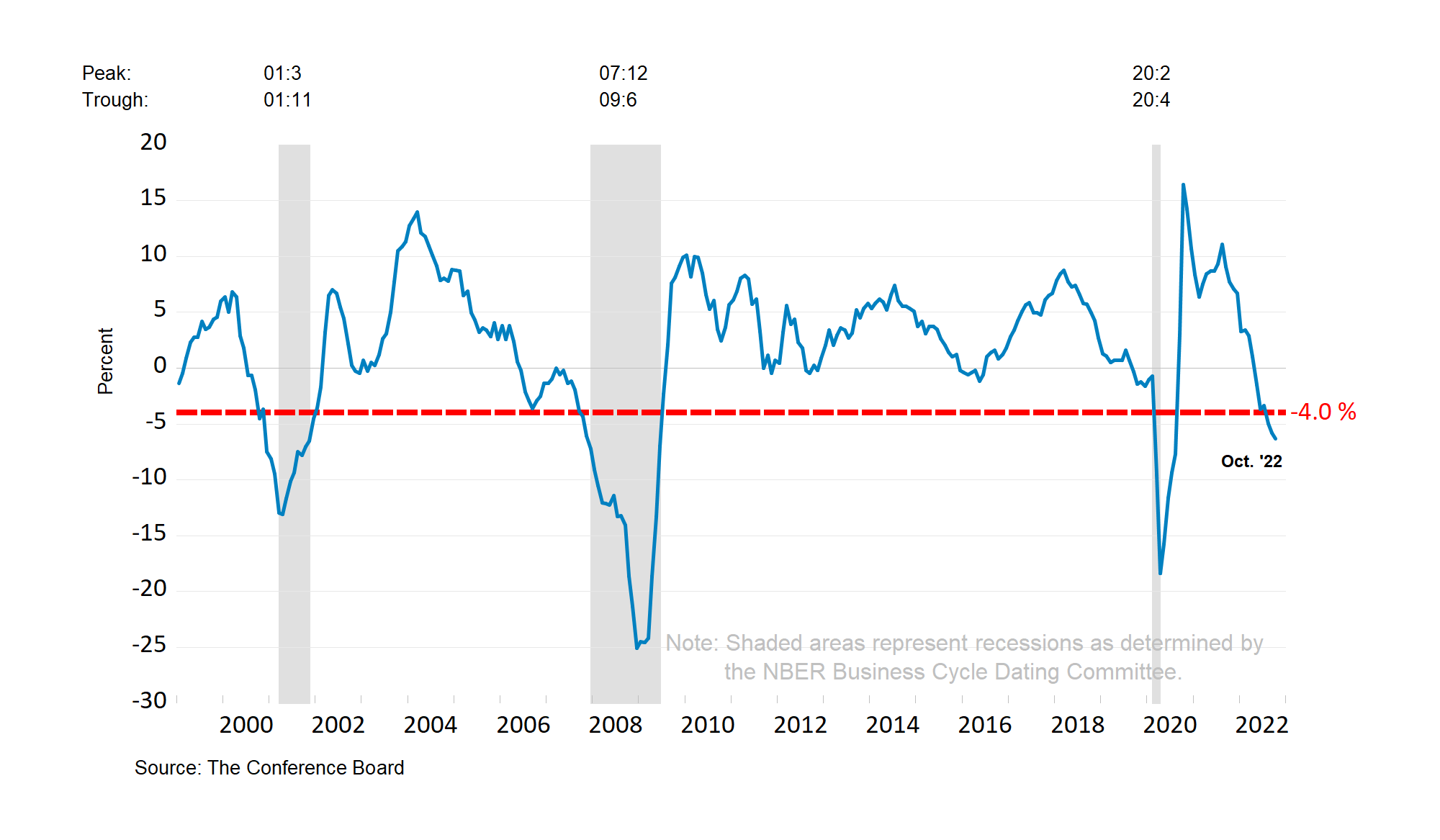

Leading Economic Indicators and the Recession

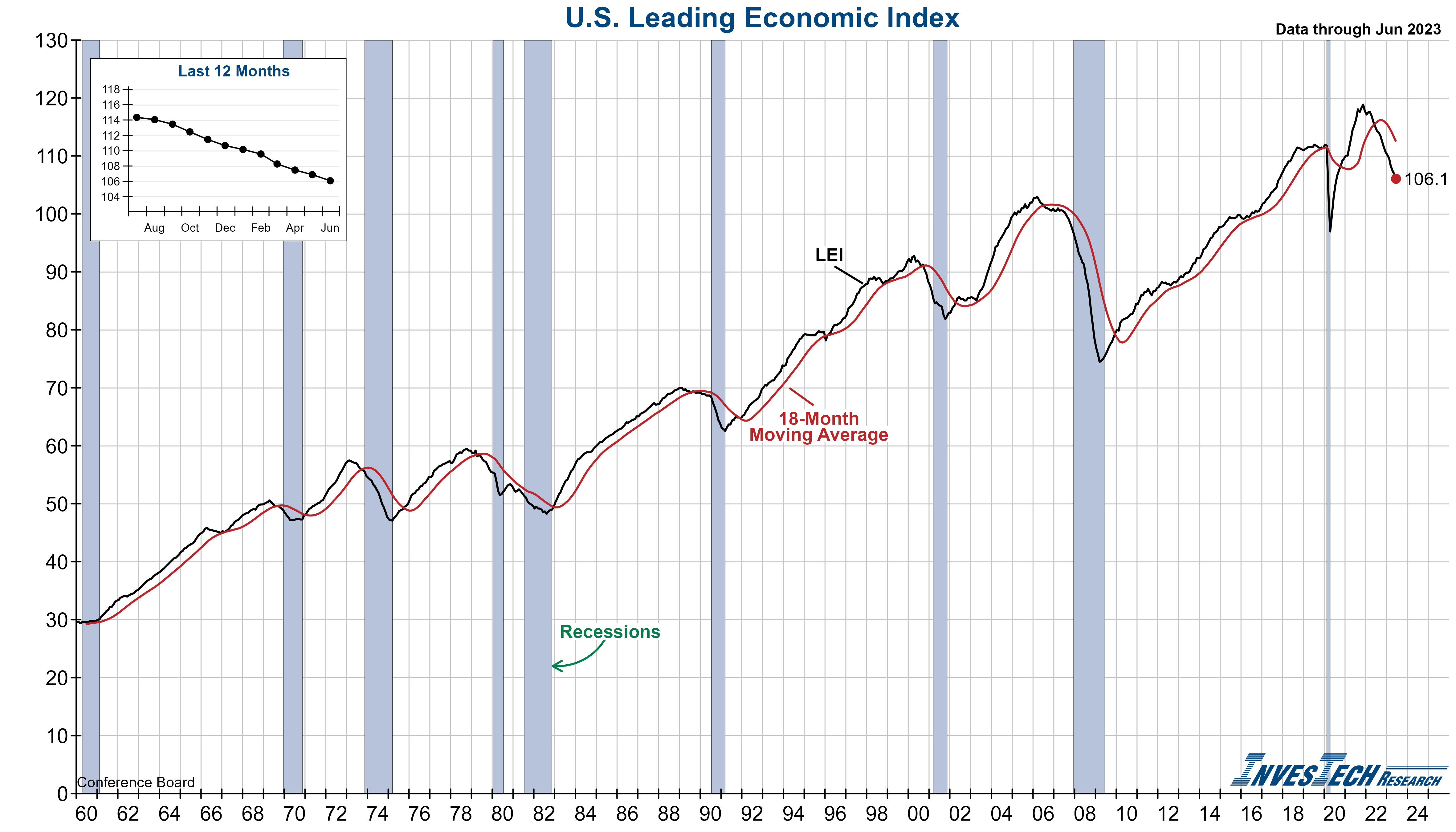

The Conference Board's Leading Economic Index Adjusted For Population Growth Seeking Alpha

October 2015 Leading Economic Index Improved

Conference Board Leading Economic Index (LEI)

The Conference Board Leading Economic Indicator (LEI) QTR Capital Management LLC

EconomicGreenfield Updates Of Economic Indicators June 2024

The New Conference Board Leading Economic Index Phil's Stock World

The Leading Economic Indicator (LEI) and business cycle fluctuations. Download Scientific Diagram

The Business Cycle.

The Conference Board Leading Economic Index® (Lei) For The Us Fell In March The Conference Board Leading Economic Index® (Lei) For The Us Declined By 0.7% In March 2025 To 100.5.

The Leading, Coincident, And Lagging Indexes Are Designed To Signal Peaks And Troughs In The Business Cycle For Major Economies Around The World.

The Conference Board Leading Economic Index® (Lei) For The Us Plunged In April The Conference Board Leading Economic Index® (Lei) For The Us Fell Sharply By 1.0% In April.

Related Post: