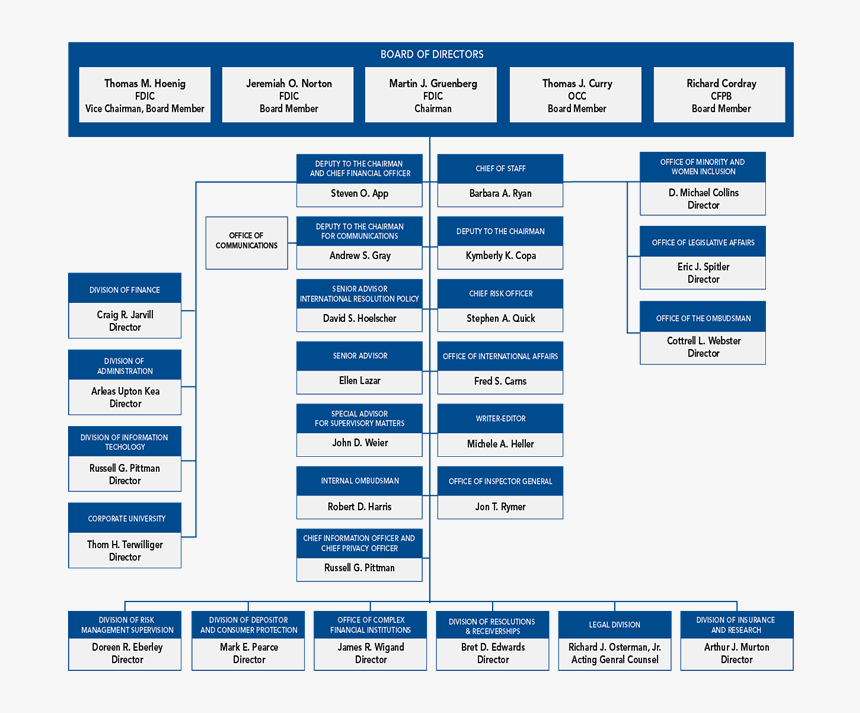

Fdic Org Chart

Fdic Org Chart - The primary role of the. Federal deposit insurance corporation (fdic) the federal deposit insurance corporation (fdic) is a us government institution that provides deposit insurance against bank failure. Fdic insurance protects customers from bank failures and insolvency, guaranteeing their funds are secure even if the institution fails or goes bankrupt. Learn what the fdic is, how it protects your bank deposits, and why it's important for u.s. The federal deposit insurance corp. Federal deposit insurance corporation (fdic), a u.s. Insurance coverage the fdic insures deposits at member banks in the event that a bank fails—that is, the bank's regulating authority decides that it no longer meets the requirements. (fdic) is an independent federal agency that provides insurance to u.s. The federal deposit insurance corporation (fdic) is an independent agency created by the congress to maintain stability and public confidence in the nation’s financial system. When it was established in 1933, some 4,000 banks had closed in the first few months alone. Fdic insurance is backed by the full faith and credit of the. Federal deposit insurance corporation (fdic), a u.s. Fdic insurance protects customers from bank failures and insolvency, guaranteeing their funds are secure even if the institution fails or goes bankrupt. The fdic is the agency that insures deposits at member banks in case of a bank failure. Insurance coverage the fdic insures deposits at member banks in the event that a bank fails—that is, the bank's regulating authority decides that it no longer meets the requirements. The fdic is relying on one of its main tools — deposit insurance — to prevent. When it was established in 1933, some 4,000 banks had closed in the first few months alone. (fdic) is an independent federal agency that provides insurance to u.s. Federal deposit insurance corporation (fdic) the federal deposit insurance corporation (fdic) is a us government institution that provides deposit insurance against bank failure. The fdic provides deposit insurance to protect your money in the event of a bank failure. The fdic provides deposit insurance to protect your money in the event of a bank failure. The fdic is relying on one of its main tools — deposit insurance — to prevent. The primary role of the. When it was established in 1933, some 4,000 banks had closed in the first few months alone. The federal deposit insurance corp. Fdic insurance is backed by the full faith and credit of the. Federal deposit insurance corporation (fdic) the federal deposit insurance corporation (fdic) is a us government institution that provides deposit insurance against bank failure. Learn what the fdic is, how it protects your bank deposits, and why it's important for u.s. (fdic) is an independent federal agency that provides. Fdic insurance protects customers from bank failures and insolvency, guaranteeing their funds are secure even if the institution fails or goes bankrupt. The federal deposit insurance corporation (fdic) is an independent agency created by the congress to maintain stability and public confidence in the nation’s financial system. The federal deposit insurance corp. The fdic is relying on one of its. The primary role of the. Insurance coverage the fdic insures deposits at member banks in the event that a bank fails—that is, the bank's regulating authority decides that it no longer meets the requirements. Fdic insurance is backed by the full faith and credit of the. The fdic is relying on one of its main tools — deposit insurance —. Learn what the fdic is, how it protects your bank deposits, and why it's important for u.s. The fdic is relying on one of its main tools — deposit insurance — to prevent. Federal deposit insurance corporation (fdic) the federal deposit insurance corporation (fdic) is a us government institution that provides deposit insurance against bank failure. We also cover what. Federal deposit insurance corporation (fdic) the federal deposit insurance corporation (fdic) is a us government institution that provides deposit insurance against bank failure. The fdic is the agency that insures deposits at member banks in case of a bank failure. The federal deposit insurance corp. (fdic) is an independent federal agency that provides insurance to u.s. When it was established. Federal deposit insurance corporation (fdic), a u.s. Insurance coverage the fdic insures deposits at member banks in the event that a bank fails—that is, the bank's regulating authority decides that it no longer meets the requirements. We also cover what you need to know about the fdic. The federal deposit insurance corporation (fdic) is an independent agency created by the. (fdic) is an independent federal agency that provides insurance to u.s. Federal deposit insurance corporation (fdic) the federal deposit insurance corporation (fdic) is a us government institution that provides deposit insurance against bank failure. Learn what the fdic is, how it protects your bank deposits, and why it's important for u.s. The fdic is relying on one of its main. The fdic is the agency that insures deposits at member banks in case of a bank failure. Fdic insurance protects customers from bank failures and insolvency, guaranteeing their funds are secure even if the institution fails or goes bankrupt. Fdic insurance is backed by the full faith and credit of the. Federal deposit insurance corporation (fdic) the federal deposit insurance. Fdic insurance is backed by the full faith and credit of the. The fdic is relying on one of its main tools — deposit insurance — to prevent. The fdic provides deposit insurance to protect your money in the event of a bank failure. The primary role of the. When it was established in 1933, some 4,000 banks had closed. Federal deposit insurance corporation (fdic) the federal deposit insurance corporation (fdic) is a us government institution that provides deposit insurance against bank failure. We also cover what you need to know about the fdic. When it was established in 1933, some 4,000 banks had closed in the first few months alone. The primary role of the. Fdic insurance protects customers from bank failures and insolvency, guaranteeing their funds are secure even if the institution fails or goes bankrupt. Insurance coverage the fdic insures deposits at member banks in the event that a bank fails—that is, the bank's regulating authority decides that it no longer meets the requirements. The fdic provides deposit insurance to protect your money in the event of a bank failure. The federal deposit insurance corporation (fdic) is an independent agency created by the congress to maintain stability and public confidence in the nation’s financial system. The federal deposit insurance corp. Federal deposit insurance corporation (fdic), a u.s. (fdic) is an independent federal agency that provides insurance to u.s. The fdic is the agency that insures deposits at member banks in case of a bank failure.FDIC Insurance What to Know SageVest Wealth Management

FDIC Speeches, Statements & Testimonies 5/31/2023 Remarks by FDIC Chairman Martin Gruenberg

FDIC Speeches & Testimony 2/28/2023 Remarks by FDIC Chairman Martin Gruenberg on the Fourth

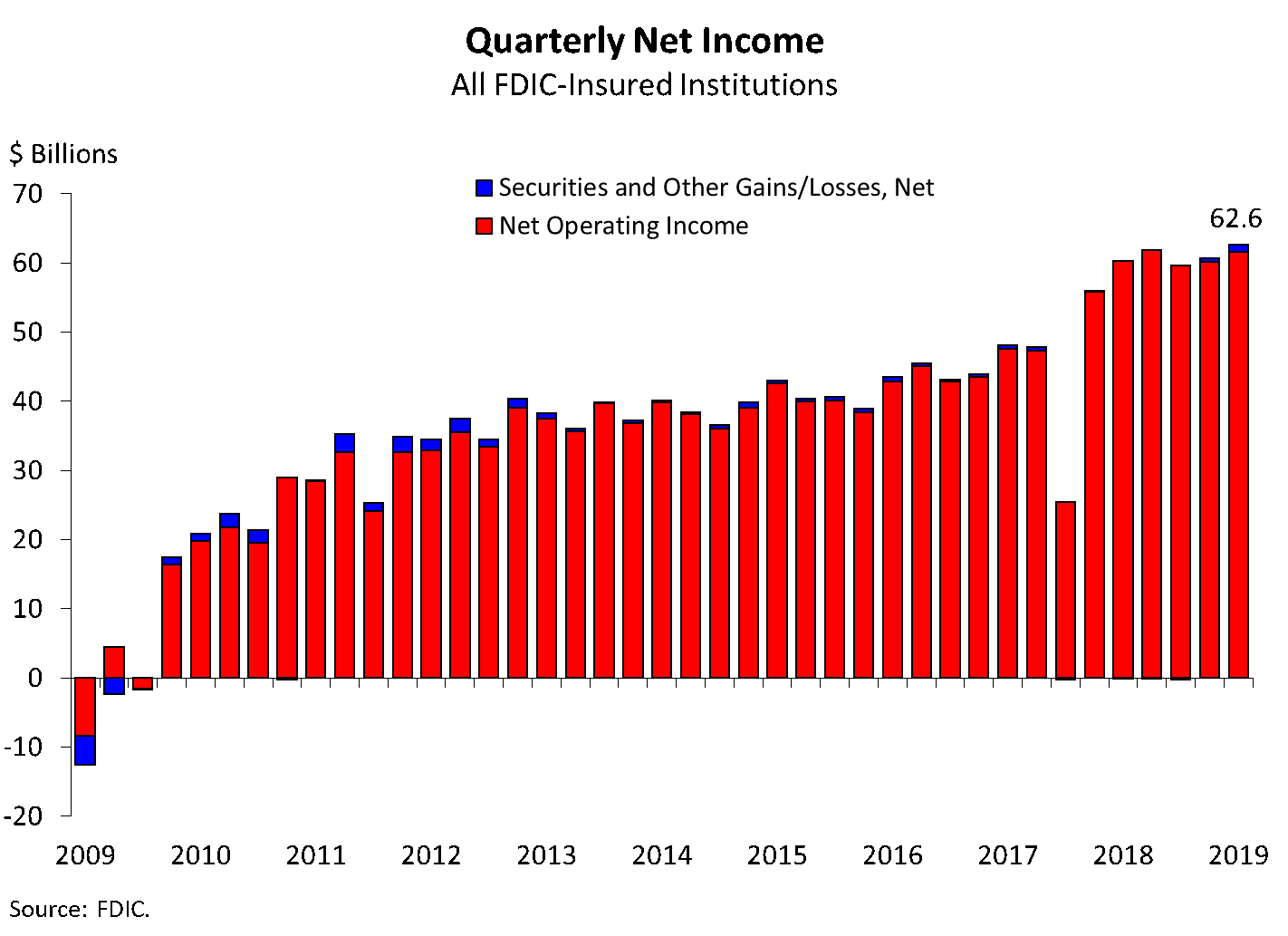

FDIC PR182020 2/25/2020

Would Project 2025 eliminate the FDIC? What we can VERIFY

FDIC PR642022 9/8/2022

FDIC Speeches & Testimony 9/5/2019

Custom Chart Tool Instructions FDIC

Fdic Organizational Chart Organizational Structure Of Oxford University, HD Png Download kindpng

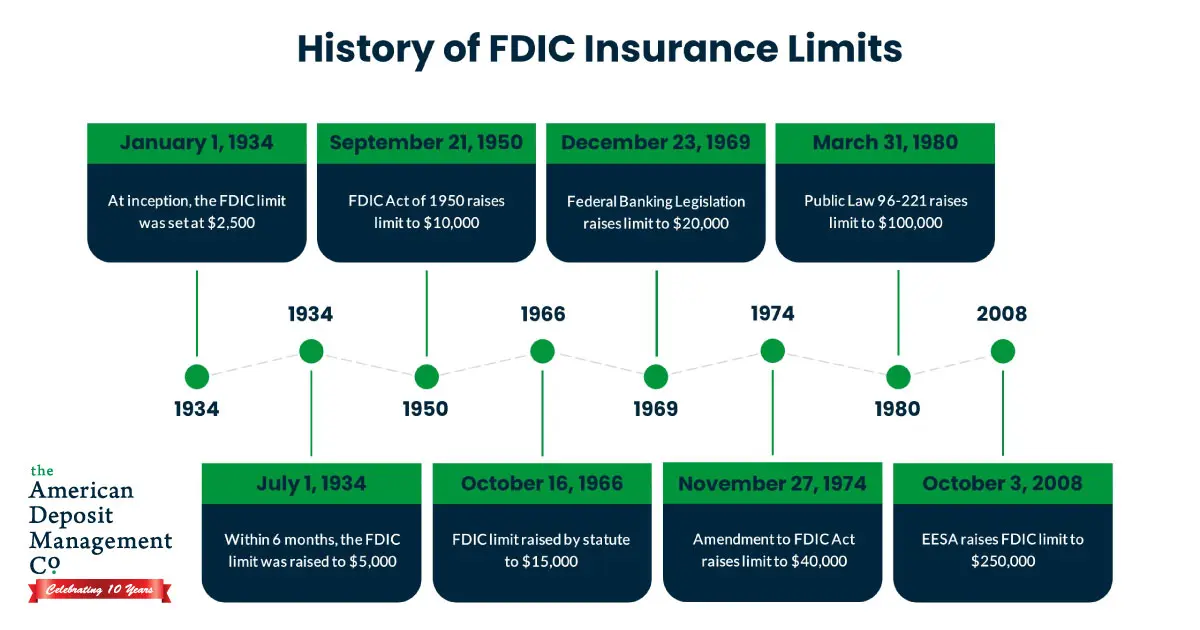

History and Timeline of Changes to FDIC Coverage Limits ADM

The Fdic Is Relying On One Of Its Main Tools — Deposit Insurance — To Prevent.

Fdic Insurance Is Backed By The Full Faith And Credit Of The.

Learn What The Fdic Is, How It Protects Your Bank Deposits, And Why It's Important For U.s.

Related Post: