Fannie C Williams Charter

Fannie C Williams Charter - Part c describes the requirements associated with the two primary ways lenders transact business with fannie mae: Fannie mae is creating more options for more homebuyers by tackling access to credit and housing affordability challenges. We provide our customers a variety of innovative loan. We serve homebuyers, homeowners, and renters by creating solutions that expand equitable access to affordable housing. Selling whole loans for cash and pooling loans into fannie mae. As a resource for homeowners. Fannie mae is a leading provider of mortgage financing in the u.s. Powering america’s housing we help make housing more accessible and affordable. Federal housing (fhfa) publishes annual conforming loan limit values that apply to all conventional loans delivered to fannie mae. What does fannie mae do? What does fannie mae do? Federal housing (fhfa) publishes annual conforming loan limit values that apply to all conventional loans delivered to fannie mae. For almost 90 years, fannie mae has provided a reliable source of affordable mortgage credit that supports homebuyers and renters across the country. Part c describes the requirements associated with the two primary ways lenders transact business with fannie mae: Selling whole loans for cash and pooling loans into fannie mae. As a resource for homeowners. We provide our customers a variety of innovative loan. We develop and maintain underwriting and eligibility standards for fannie mae loans. We serve homebuyers, homeowners, and renters by creating solutions that expand equitable access to affordable housing. Fannie mae is creating more options for more homebuyers by tackling access to credit and housing affordability challenges. Fannie mae is a leading provider of mortgage financing in the u.s. Part c describes the requirements associated with the two primary ways lenders transact business with fannie mae: Selling whole loans for cash and pooling loans into fannie mae. We serve homebuyers, homeowners, and renters by creating solutions that expand equitable access to affordable housing. Federal housing (fhfa) publishes. We serve homebuyers, homeowners, and renters by creating solutions that expand equitable access to affordable housing. We develop and maintain underwriting and eligibility standards for fannie mae loans. What does fannie mae do? We purchase mortgages from lenders to free up the money they need to make other mortgage loans, therefore ensuring the. Federal housing (fhfa) publishes annual conforming loan. Part c describes the requirements associated with the two primary ways lenders transact business with fannie mae: Selling whole loans for cash and pooling loans into fannie mae. Fannie mae is a leading provider of mortgage financing in the u.s. We develop and maintain underwriting and eligibility standards for fannie mae loans. What does fannie mae do? Part c describes the requirements associated with the two primary ways lenders transact business with fannie mae: We serve homebuyers, homeowners, and renters by creating solutions that expand equitable access to affordable housing. Fannie mae is a leading provider of mortgage financing in the u.s. We develop and maintain underwriting and eligibility standards for fannie mae loans. We provide our. Fannie mae is creating more options for more homebuyers by tackling access to credit and housing affordability challenges. We provide our customers a variety of innovative loan. For almost 90 years, fannie mae has provided a reliable source of affordable mortgage credit that supports homebuyers and renters across the country. We purchase mortgages from lenders to free up the money. Powering america’s housing we help make housing more accessible and affordable. For almost 90 years, fannie mae has provided a reliable source of affordable mortgage credit that supports homebuyers and renters across the country. We develop and maintain underwriting and eligibility standards for fannie mae loans. Fannie mae is a leading provider of mortgage financing in the u.s. We provide. We serve homebuyers, homeowners, and renters by creating solutions that expand equitable access to affordable housing. Selling whole loans for cash and pooling loans into fannie mae. We purchase mortgages from lenders to free up the money they need to make other mortgage loans, therefore ensuring the. Powering america’s housing we help make housing more accessible and affordable. We develop. Federal housing (fhfa) publishes annual conforming loan limit values that apply to all conventional loans delivered to fannie mae. For almost 90 years, fannie mae has provided a reliable source of affordable mortgage credit that supports homebuyers and renters across the country. We purchase mortgages from lenders to free up the money they need to make other mortgage loans, therefore. Federal housing (fhfa) publishes annual conforming loan limit values that apply to all conventional loans delivered to fannie mae. Part c describes the requirements associated with the two primary ways lenders transact business with fannie mae: Fannie mae is creating more options for more homebuyers by tackling access to credit and housing affordability challenges. We purchase mortgages from lenders to. We develop and maintain underwriting and eligibility standards for fannie mae loans. Fannie mae is creating more options for more homebuyers by tackling access to credit and housing affordability challenges. We provide our customers a variety of innovative loan. Powering america’s housing we help make housing more accessible and affordable. Selling whole loans for cash and pooling loans into fannie. We purchase mortgages from lenders to free up the money they need to make other mortgage loans, therefore ensuring the. We serve homebuyers, homeowners, and renters by creating solutions that expand equitable access to affordable housing. We develop and maintain underwriting and eligibility standards for fannie mae loans. We provide our customers a variety of innovative loan. As a resource for homeowners. Part c describes the requirements associated with the two primary ways lenders transact business with fannie mae: Federal housing (fhfa) publishes annual conforming loan limit values that apply to all conventional loans delivered to fannie mae. Fannie mae is a leading provider of mortgage financing in the u.s. What does fannie mae do? Selling whole loans for cash and pooling loans into fannie mae.Fannie C Williams Charter School

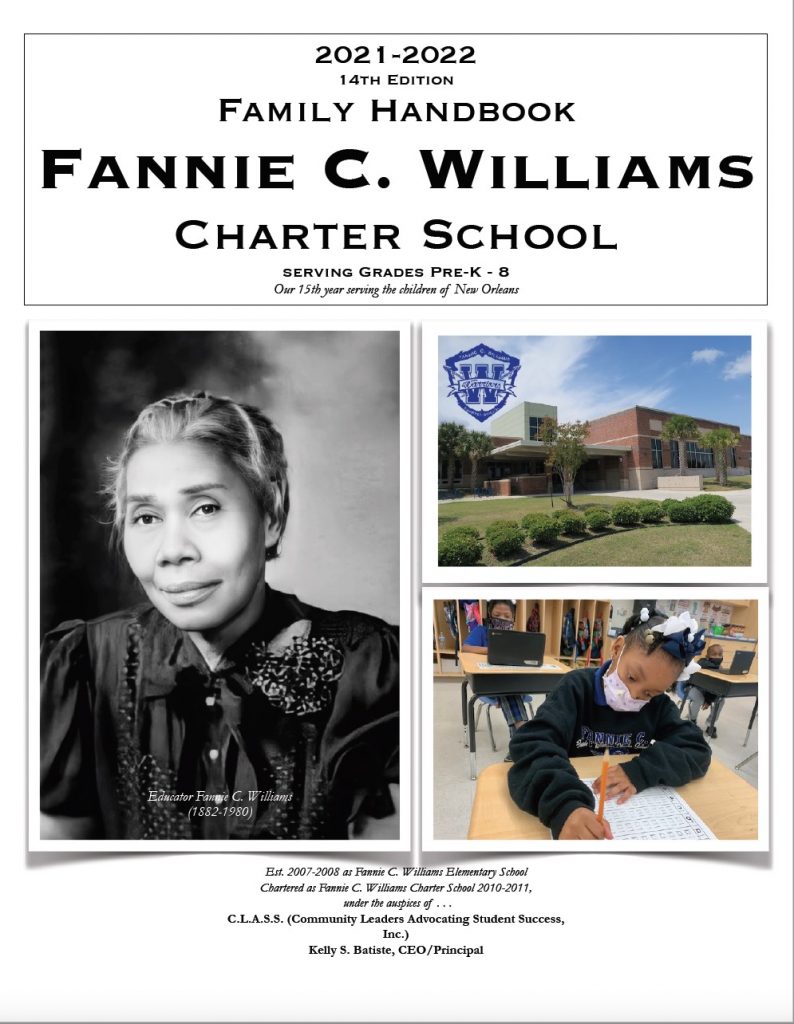

IMPORTANT INFORMATION Fannie C Williams Charter School

Fannie C Williams Charter School

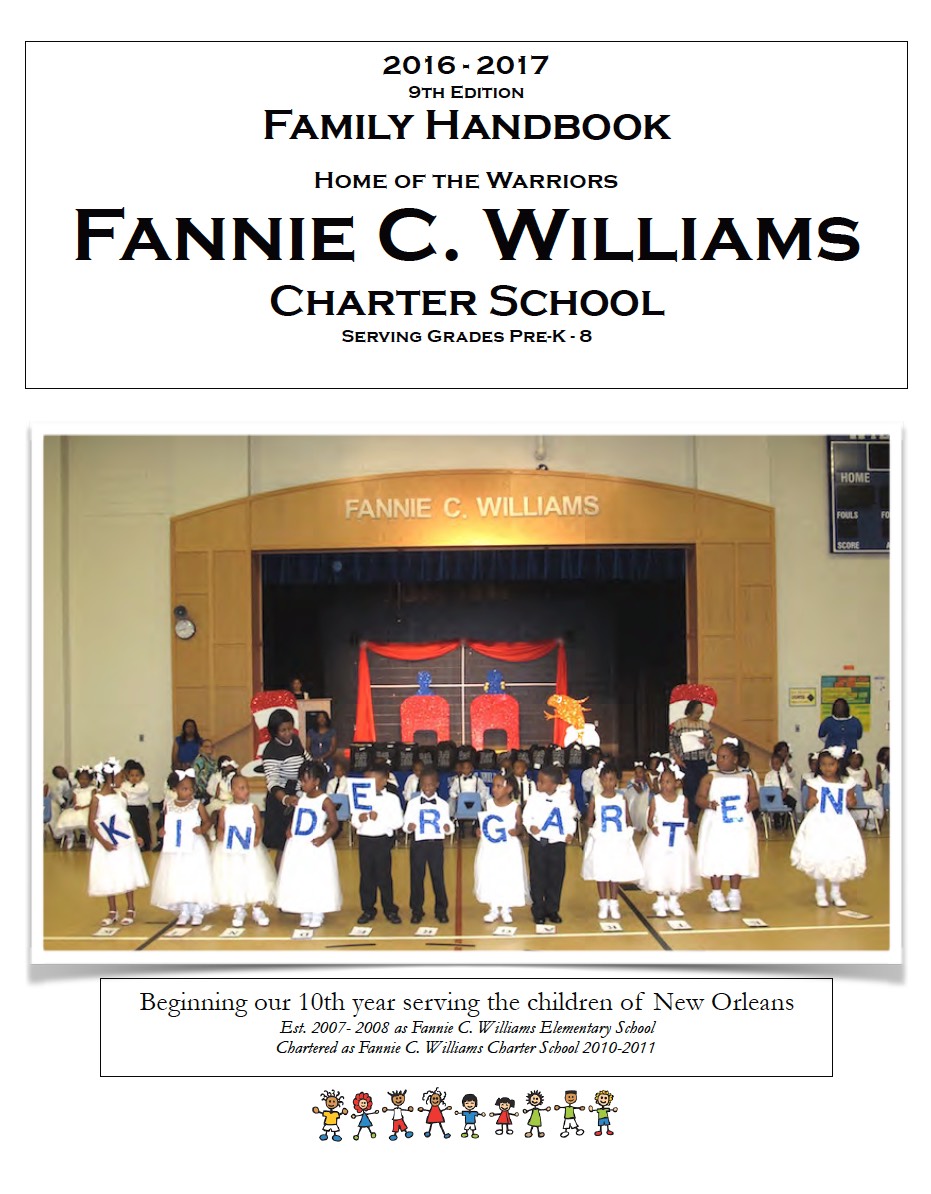

Fannie C Williams Charter Family Handbook 20162017

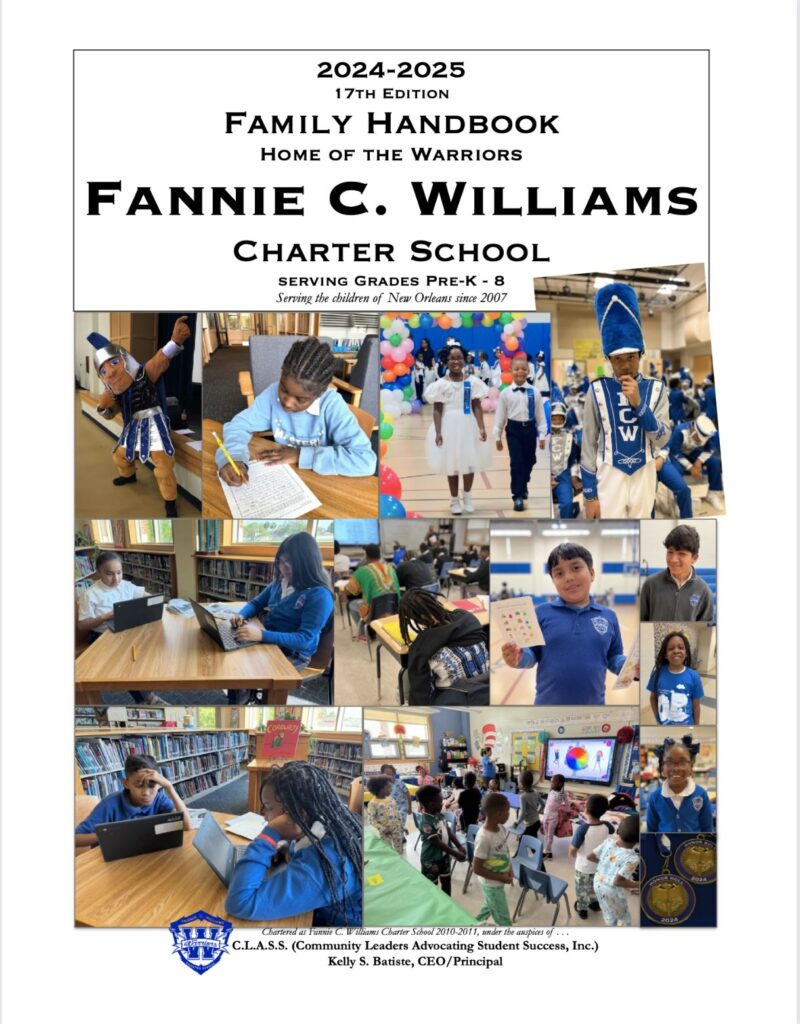

Fannie C Williams Charter Family Handbook 20242025 Fannie C Williams Charter School

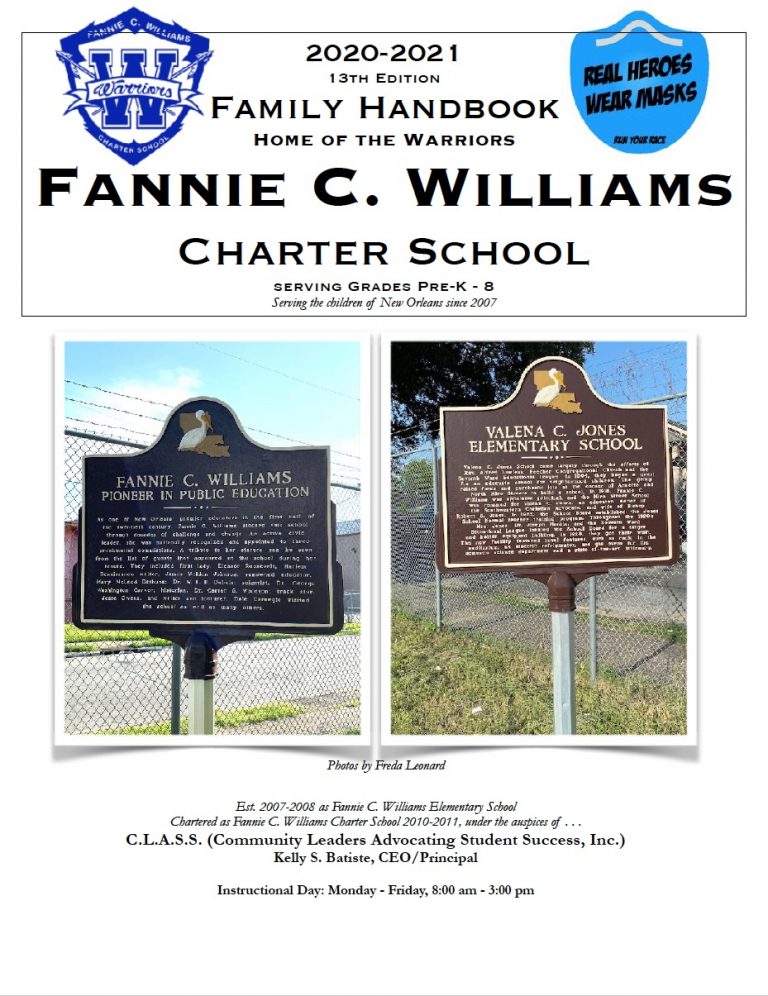

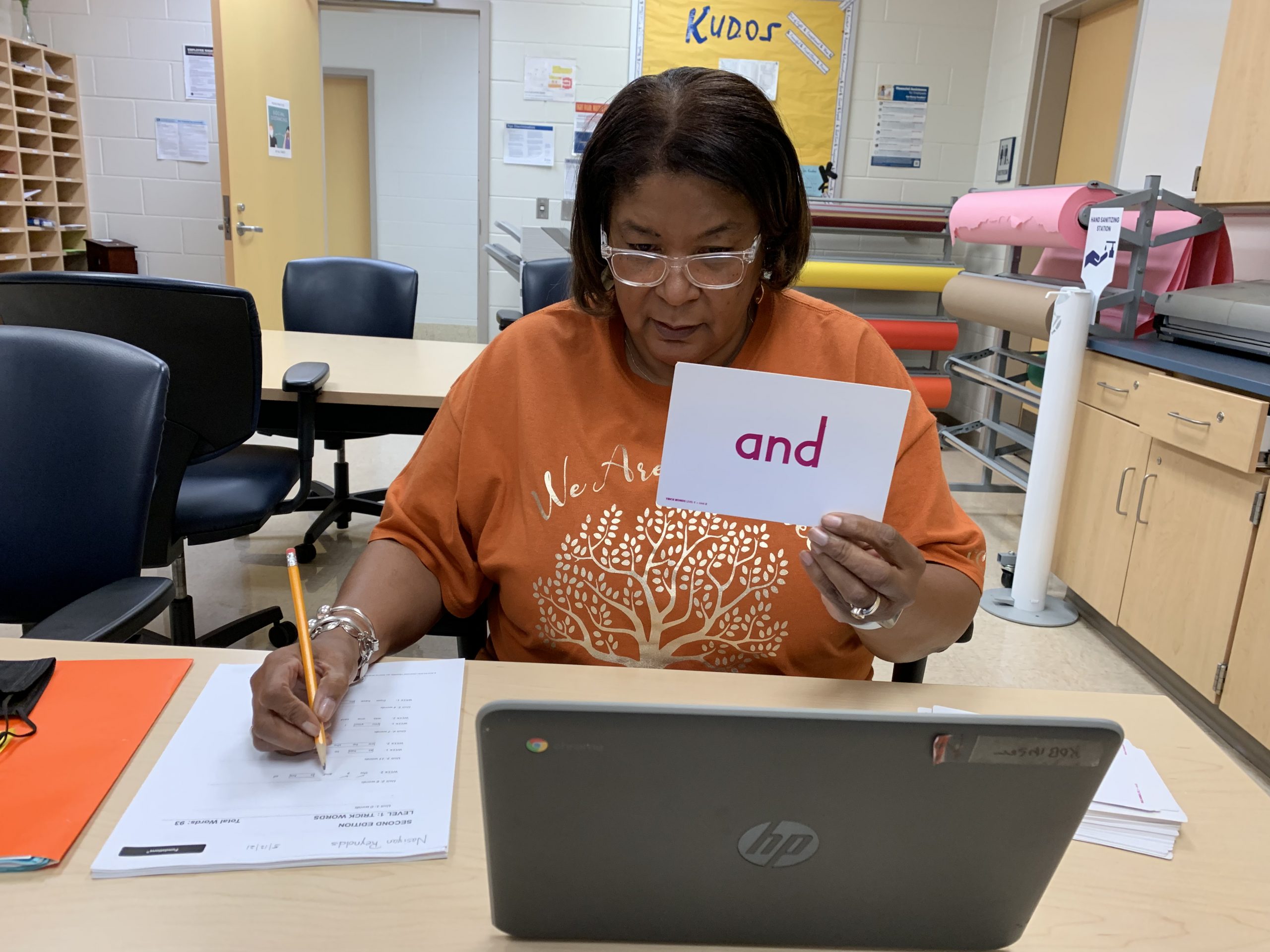

Fannie C Williams Charter Family Handbook 20202021

Fannie C Williams Charter Family Handbook

Fannie C Williams Charter Family Handbook

Fannie C Williams Charter Family Handbook 20232024 Fannie C Williams Charter School

Fannie C Williams Charter School

Powering America’s Housing We Help Make Housing More Accessible And Affordable.

Fannie Mae Is Creating More Options For More Homebuyers By Tackling Access To Credit And Housing Affordability Challenges.

For Almost 90 Years, Fannie Mae Has Provided A Reliable Source Of Affordable Mortgage Credit That Supports Homebuyers And Renters Across The Country.

Related Post: