Eitc Tax Credit Chart

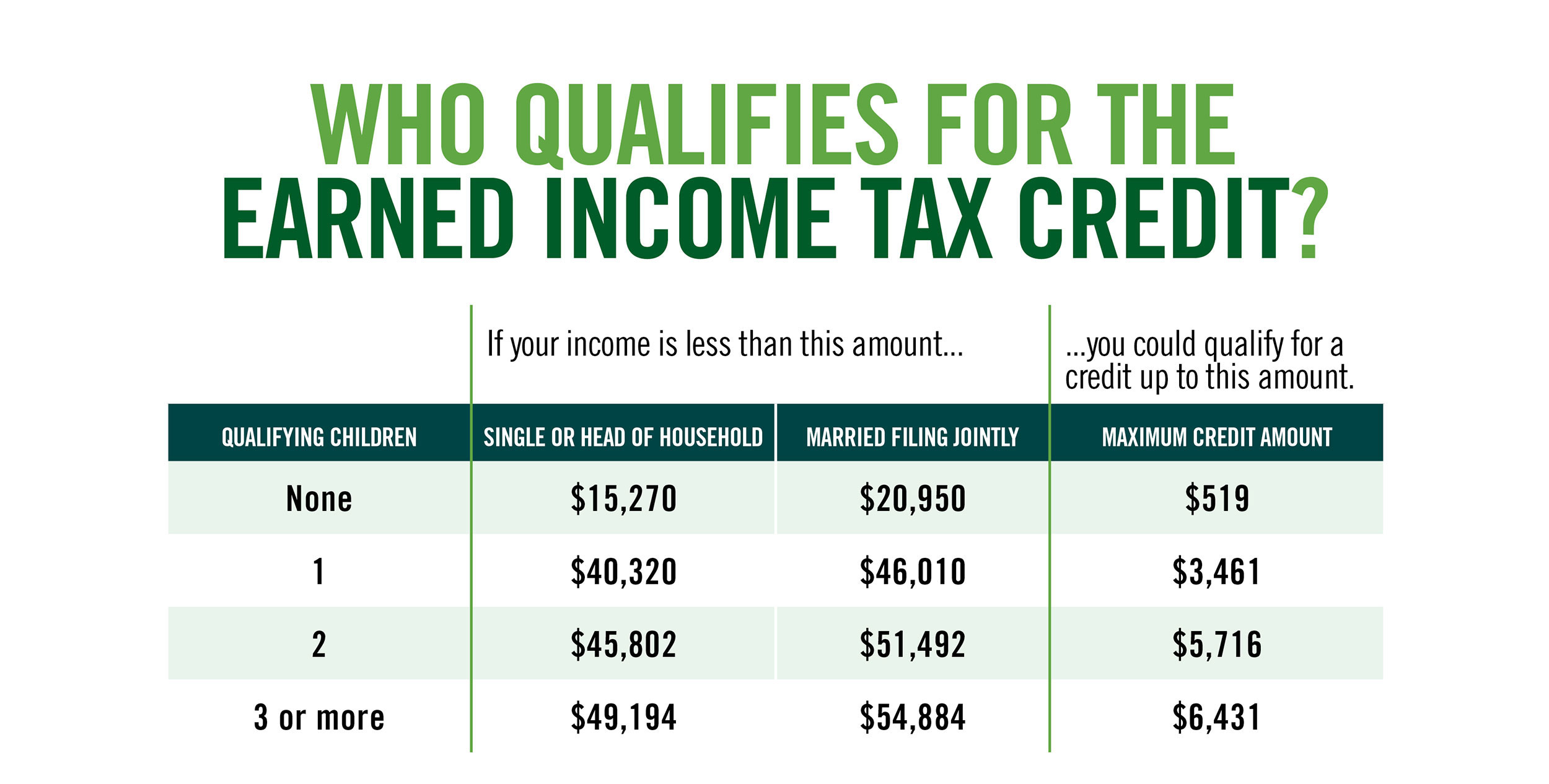

Eitc Tax Credit Chart - The amount of the eitc depends on the amount you earned from working for someone or for yourself,. 50 years of strengthening america’s working families join us in celebrating the earned income tax credit (eitc)! It promotes awareness of eitc eligibility and where to find additional eitc information. Taxpayers claiming the eitc who file married filing separately must meet the eligibility requirements under the special rule in the american rescue plan act (arpa) of 2021. Common eitc questions and answers find the answers to the questions clients ask about eitc. Publication 962 (en/sp), earned income tax credit pdf (english on one side;. Earned income tax credit (eitc) credit for other dependents (odc) child and dependent care credit (cdcc) head of household (hoh) filing status the child must meet the. Education credit/aotc and lifetime learning credits if you haven't found the answer to your. Due diligence videos tie breaker rule does aunt joan qualify for eitc in tax tales: The preparer must take a closer look at aunt joan's agi and. Publication 962 (en/sp), earned income tax credit pdf (english on one side;. Common eitc questions and answers find the answers to the questions clients ask about eitc. The preparer must take a closer look at aunt joan's agi and. Taxpayers claiming the eitc who file married filing separately must meet the eligibility requirements under the special rule in the american rescue plan act (arpa) of 2021. Education credit/aotc and lifetime learning credits if you haven't found the answer to your. It promotes awareness of eitc eligibility and where to find additional eitc information. 50 years of strengthening america’s working families join us in celebrating the earned income tax credit (eitc)! Due diligence videos tie breaker rule does aunt joan qualify for eitc in tax tales: The following items answer questions preparers have asked about the basic qualifications for all taxpayers claiming the earned income tax credit (eitc), the child tax credit (ctc), the. The case of the unclear aunt? Earned income tax credit (eitc) credit for other dependents (odc) child and dependent care credit (cdcc) head of household (hoh) filing status the child must meet the. Taxpayers claiming the eitc who file married filing separately must meet the eligibility requirements under the special rule in the american rescue plan act (arpa) of 2021. Education credit/aotc and lifetime learning credits. Taxpayers claiming the eitc who file married filing separately must meet the eligibility requirements under the special rule in the american rescue plan act (arpa) of 2021. 50 years of strengthening america’s working families join us in celebrating the earned income tax credit (eitc)! The amount of the eitc depends on the amount you earned from working for someone or. The amount of the eitc depends on the amount you earned from working for someone or for yourself,. Income limits and amount of eitc for additional tax years see the earned income, investment income, and adjusted gross income (agi) limits, as well as the maximum credit amounts for the. The preparer must take a closer look at aunt joan's agi. The following items answer questions preparers have asked about the basic qualifications for all taxpayers claiming the earned income tax credit (eitc), the child tax credit (ctc), the. Income limits and amount of eitc for additional tax years see the earned income, investment income, and adjusted gross income (agi) limits, as well as the maximum credit amounts for the. Due. The amount of the eitc depends on the amount you earned from working for someone or for yourself,. Due diligence videos tie breaker rule does aunt joan qualify for eitc in tax tales: Income limits and amount of eitc for additional tax years see the earned income, investment income, and adjusted gross income (agi) limits, as well as the maximum. The amount of the eitc depends on the amount you earned from working for someone or for yourself,. Publication 962 (en/sp), earned income tax credit pdf (english on one side;. Due diligence videos tie breaker rule does aunt joan qualify for eitc in tax tales: Earned income tax credit (eitc) credit for other dependents (odc) child and dependent care credit. The preparer must take a closer look at aunt joan's agi and. The case of the unclear aunt? Income limits and amount of eitc for additional tax years see the earned income, investment income, and adjusted gross income (agi) limits, as well as the maximum credit amounts for the. Due diligence videos tie breaker rule does aunt joan qualify for. Education credit/aotc and lifetime learning credits if you haven't found the answer to your. The following items answer questions preparers have asked about the basic qualifications for all taxpayers claiming the earned income tax credit (eitc), the child tax credit (ctc), the. Income limits and amount of eitc for additional tax years see the earned income, investment income, and adjusted. Income limits and amount of eitc for additional tax years see the earned income, investment income, and adjusted gross income (agi) limits, as well as the maximum credit amounts for the. It promotes awareness of eitc eligibility and where to find additional eitc information. Due diligence videos tie breaker rule does aunt joan qualify for eitc in tax tales: The. The following items answer questions preparers have asked about the basic qualifications for all taxpayers claiming the earned income tax credit (eitc), the child tax credit (ctc), the. 50 years of strengthening america’s working families join us in celebrating the earned income tax credit (eitc)! The preparer must take a closer look at aunt joan's agi and. Common eitc questions. Education credit/aotc and lifetime learning credits if you haven't found the answer to your. Income limits and amount of eitc for additional tax years see the earned income, investment income, and adjusted gross income (agi) limits, as well as the maximum credit amounts for the. The preparer must take a closer look at aunt joan's agi and. 50 years of strengthening america’s working families join us in celebrating the earned income tax credit (eitc)! The case of the unclear aunt? Due diligence videos tie breaker rule does aunt joan qualify for eitc in tax tales: Taxpayers claiming the eitc who file married filing separately must meet the eligibility requirements under the special rule in the american rescue plan act (arpa) of 2021. The amount of the eitc depends on the amount you earned from working for someone or for yourself,. Publication 962 (en/sp), earned income tax credit pdf (english on one side;. Common eitc questions and answers find the answers to the questions clients ask about eitc.2022 Eic Tax Table Chart

Overview of the Earned Tax Credit on EITC Awareness Day

2017 vs 2018 Earned Tax Credit (EITC) Qualification and Thresholds Saving to Invest

Earned Credit 2024 Tax Table Image to u

T220252 Tax Benefit of the Earned Tax Credit (EITC), Baseline Current Law

The Federal Earned Tax Credit, Explained by Maryland Child Alliance Medium

The Earned Tax Credit (EITC) A Primer Tax Foundation

Earned Tax Credit City of Detroit

Earned Tax Credit Tax Credits for Workers and Their Families

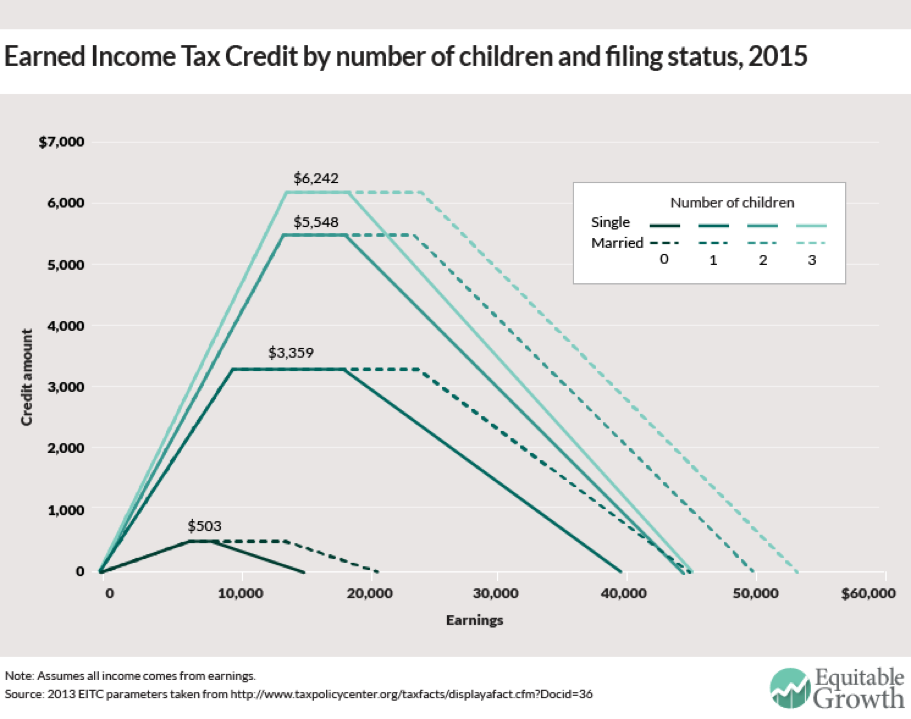

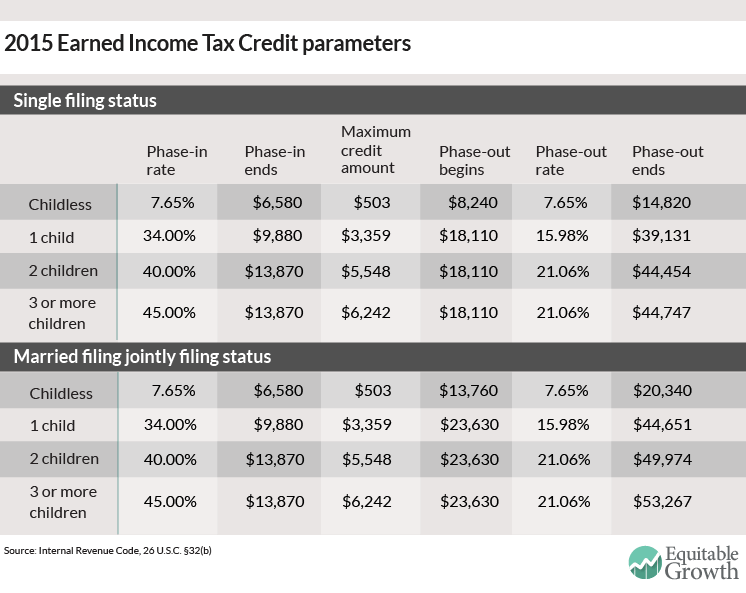

The Earned Tax Credit Equitable Growth

The Following Items Answer Questions Preparers Have Asked About The Basic Qualifications For All Taxpayers Claiming The Earned Income Tax Credit (Eitc), The Child Tax Credit (Ctc), The.

Earned Income Tax Credit (Eitc) Credit For Other Dependents (Odc) Child And Dependent Care Credit (Cdcc) Head Of Household (Hoh) Filing Status The Child Must Meet The.

It Promotes Awareness Of Eitc Eligibility And Where To Find Additional Eitc Information.

Related Post: