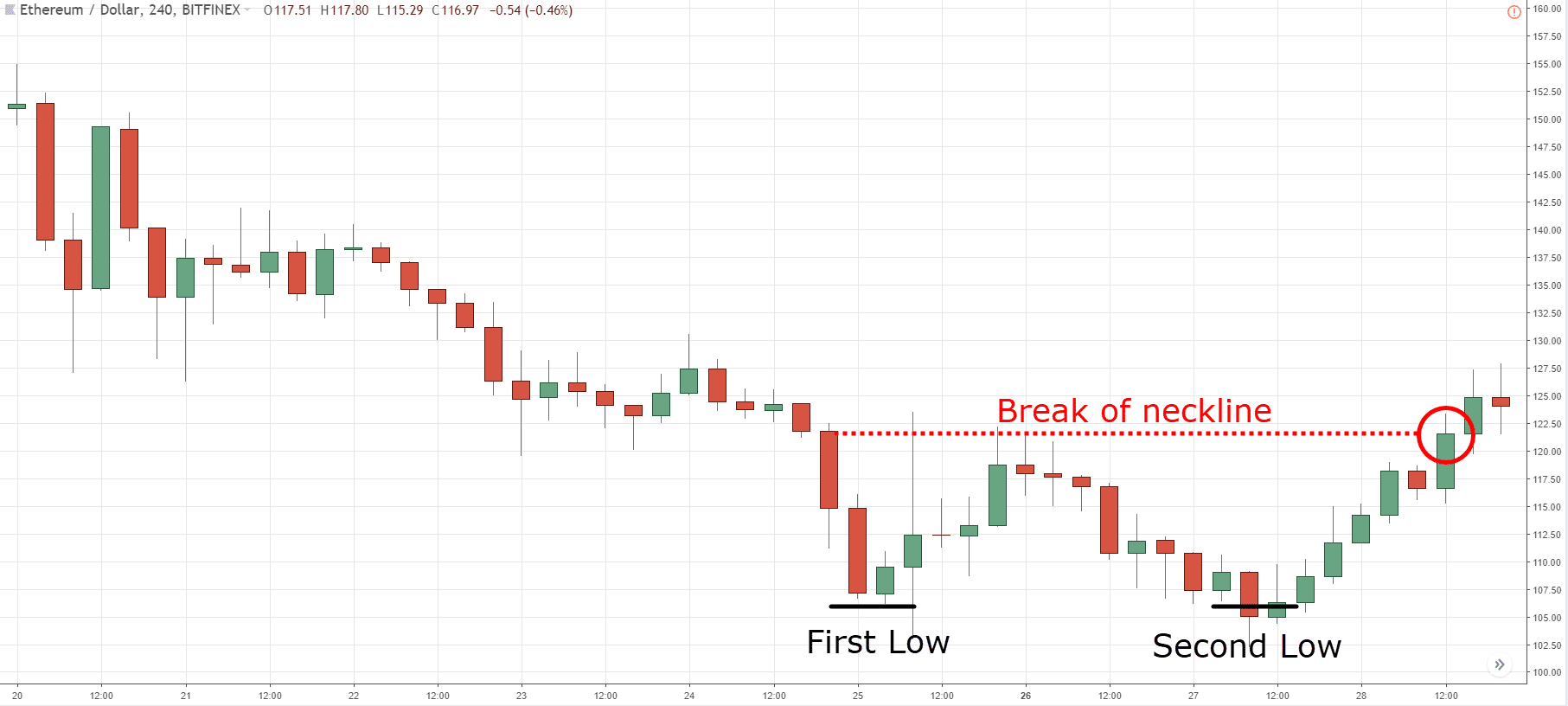

Double Bottom Chart

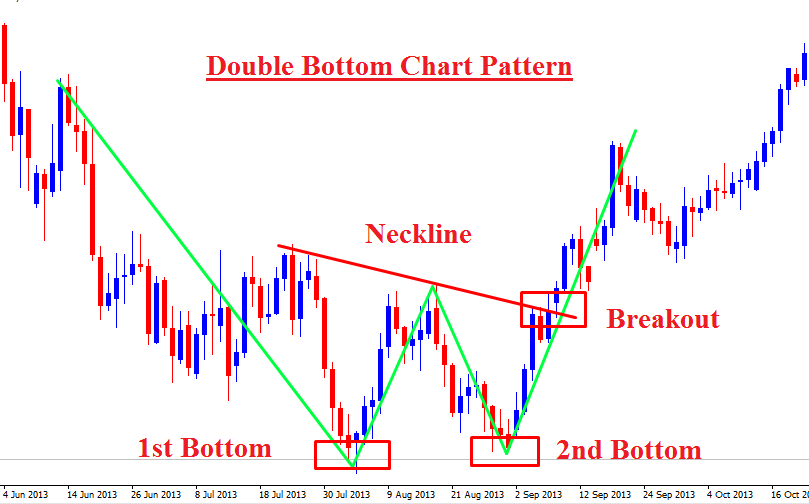

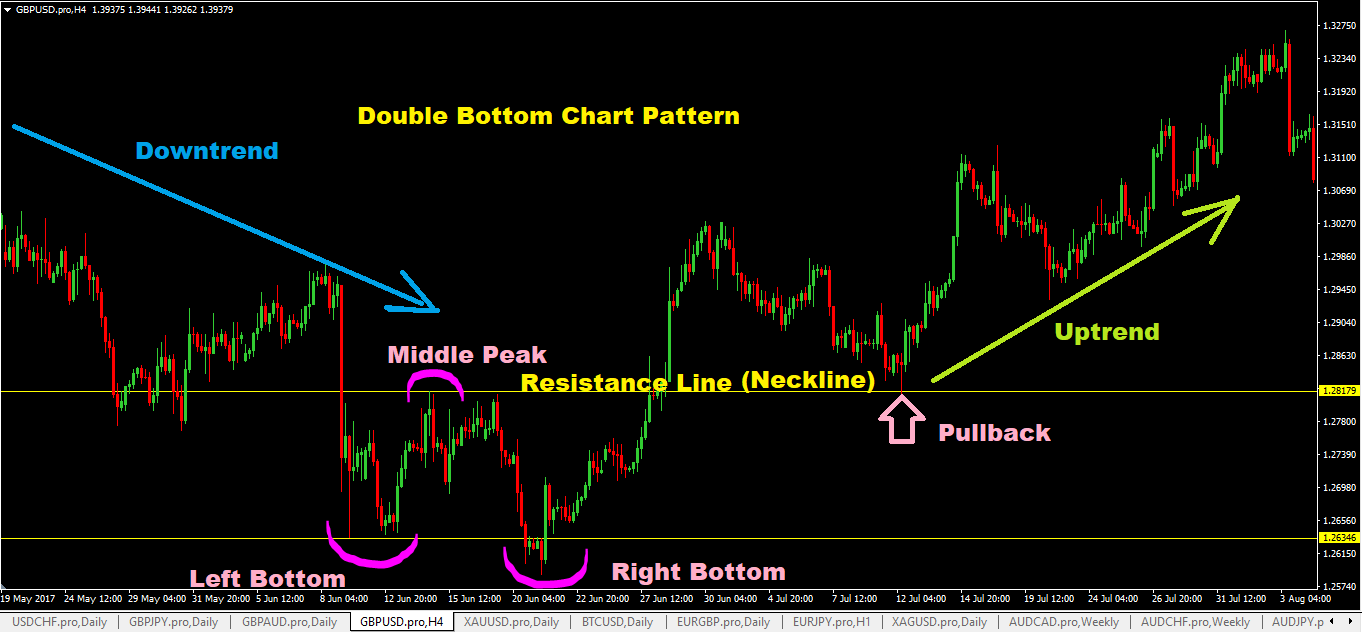

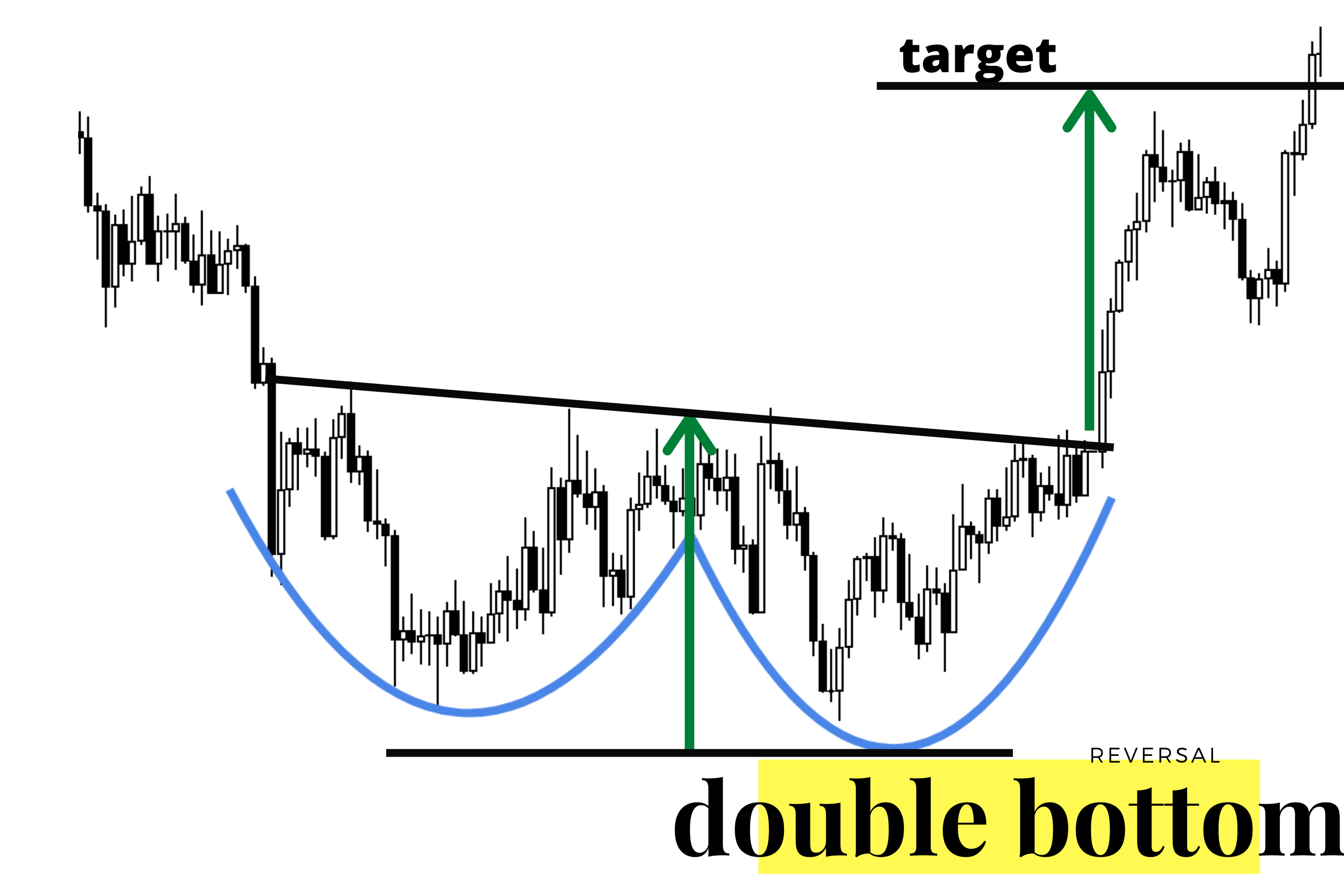

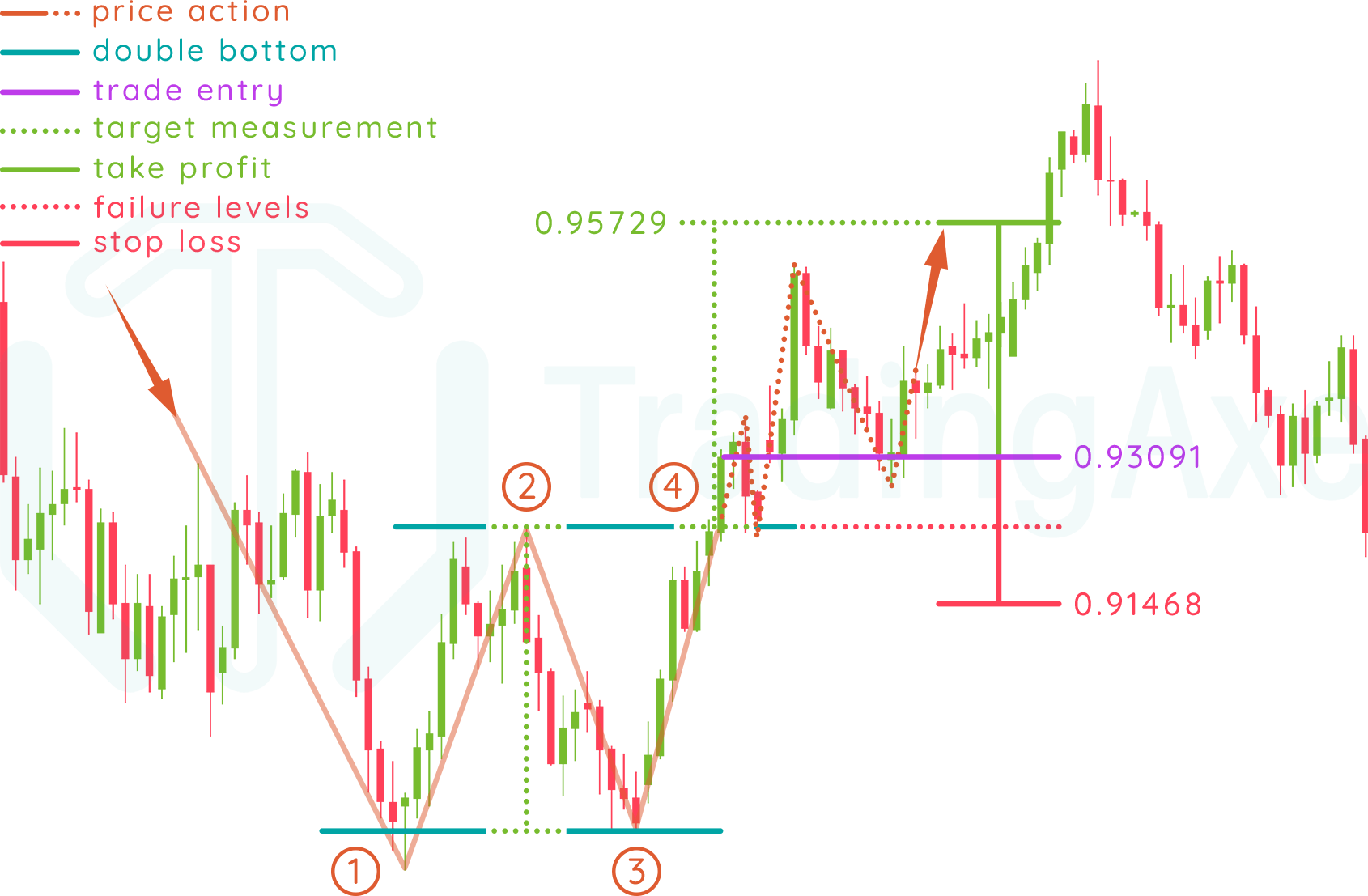

Double Bottom Chart - A double bottom pattern is a stock chart formation used in technical analysis for identifying and executing profitable trades, commonly to trade. Typically, when the 2nd peak forms, it. What is a double bottom pattern? A double bottom chart pattern is a chart pattern used in technical analysis to describe the fall in price of a stock or index, followed by a rebound, then another drop to a level that’s. The double bottom pattern is a trend reversal chart pattern formed after a continuous downward price movement for a good duration where the downward price movement loses its. A double bottom pattern consists of several candlesticks that form two valleys or support levels that are either equal or near equal height. A double bottom pattern is a classic technical analysis charting formation that represents a major change in trend and a momentum reversal from a prior down move in market. Understanding bottoming patterns like double bottoms can help you react quicker to shifts in market sentiment and potentially profit from upcoming rallies. The double bottom pattern is a technical analysis chart pattern that appears during a downtrend and indicates a possible trend reversal. It is formed by two consecutive lows that are approximately. The double bottom pattern is a trend reversal chart pattern formed after a continuous downward price movement for a good duration where the downward price movement loses its. What is a double bottom pattern? A double bottom pattern is a stock chart formation used in technical analysis for identifying and executing profitable trades, commonly to trade. Understanding bottoming patterns like double bottoms can help you react quicker to shifts in market sentiment and potentially profit from upcoming rallies. It is formed by two consecutive lows that are approximately. A double bottom chart pattern is a chart pattern used in technical analysis to describe the fall in price of a stock or index, followed by a rebound, then another drop to a level that’s. A double bottom pattern consists of several candlesticks that form two valleys or support levels that are either equal or near equal height. Typically, when the 2nd peak forms, it. A double bottom pattern is a classic technical analysis charting formation that represents a major change in trend and a momentum reversal from a prior down move in market. The double bottom pattern is a technical analysis chart pattern that appears during a downtrend and indicates a possible trend reversal. A double bottom chart pattern is a chart pattern used in technical analysis to describe the fall in price of a stock or index, followed by a rebound, then another drop to a level that’s. What is a double bottom pattern? Understanding bottoming patterns like double bottoms can help you react quicker to shifts in market sentiment and potentially profit. A double bottom pattern consists of several candlesticks that form two valleys or support levels that are either equal or near equal height. A double bottom pattern is a stock chart formation used in technical analysis for identifying and executing profitable trades, commonly to trade. The double bottom pattern is a technical analysis chart pattern that appears during a downtrend. Typically, when the 2nd peak forms, it. The double bottom pattern is a technical analysis chart pattern that appears during a downtrend and indicates a possible trend reversal. A double bottom pattern is a classic technical analysis charting formation that represents a major change in trend and a momentum reversal from a prior down move in market. Understanding bottoming patterns. It is formed by two consecutive lows that are approximately. Typically, when the 2nd peak forms, it. The double bottom pattern is a trend reversal chart pattern formed after a continuous downward price movement for a good duration where the downward price movement loses its. A double bottom pattern is a stock chart formation used in technical analysis for identifying. The double bottom pattern is a trend reversal chart pattern formed after a continuous downward price movement for a good duration where the downward price movement loses its. Understanding bottoming patterns like double bottoms can help you react quicker to shifts in market sentiment and potentially profit from upcoming rallies. A double bottom pattern is a classic technical analysis charting. A double bottom chart pattern is a chart pattern used in technical analysis to describe the fall in price of a stock or index, followed by a rebound, then another drop to a level that’s. It is formed by two consecutive lows that are approximately. What is a double bottom pattern? Understanding bottoming patterns like double bottoms can help you. Understanding bottoming patterns like double bottoms can help you react quicker to shifts in market sentiment and potentially profit from upcoming rallies. It is formed by two consecutive lows that are approximately. What is a double bottom pattern? Typically, when the 2nd peak forms, it. The double bottom pattern is a trend reversal chart pattern formed after a continuous downward. Understanding bottoming patterns like double bottoms can help you react quicker to shifts in market sentiment and potentially profit from upcoming rallies. It is formed by two consecutive lows that are approximately. A double bottom pattern consists of several candlesticks that form two valleys or support levels that are either equal or near equal height. What is a double bottom. A double bottom pattern consists of several candlesticks that form two valleys or support levels that are either equal or near equal height. The double bottom pattern is a technical analysis chart pattern that appears during a downtrend and indicates a possible trend reversal. What is a double bottom pattern? It is formed by two consecutive lows that are approximately.. A double bottom pattern is a stock chart formation used in technical analysis for identifying and executing profitable trades, commonly to trade. The double bottom pattern is a technical analysis chart pattern that appears during a downtrend and indicates a possible trend reversal. It is formed by two consecutive lows that are approximately. Typically, when the 2nd peak forms, it.. A double bottom chart pattern is a chart pattern used in technical analysis to describe the fall in price of a stock or index, followed by a rebound, then another drop to a level that’s. The double bottom pattern is a technical analysis chart pattern that appears during a downtrend and indicates a possible trend reversal. The double bottom pattern is a trend reversal chart pattern formed after a continuous downward price movement for a good duration where the downward price movement loses its. A double bottom pattern consists of several candlesticks that form two valleys or support levels that are either equal or near equal height. A double bottom pattern is a stock chart formation used in technical analysis for identifying and executing profitable trades, commonly to trade. It is formed by two consecutive lows that are approximately. Typically, when the 2nd peak forms, it. Understanding bottoming patterns like double bottoms can help you react quicker to shifts in market sentiment and potentially profit from upcoming rallies.Double Bottom Chart Pattern Forex Trading

Double Bottom Pattern Rules and Example StockManiacs

Double Bottom Chart Pattern Forex trading quotes, Stock trading learning, Trading quotes

Double Bottom Pattern A Trader’s Guide

How To Trade Double Bottom Chart Pattern TradingAxe

Double Bottom Pattern A Trader’s Guide

Double Bottom Chart Pattern Forex Trading Strategy

Double Bottom Pattern New Trader U

How To Trade Double Bottom Chart Pattern TradingAxe

The Double Bottom Pattern Trading Strategy Guide

A Double Bottom Pattern Is A Classic Technical Analysis Charting Formation That Represents A Major Change In Trend And A Momentum Reversal From A Prior Down Move In Market.

What Is A Double Bottom Pattern?

Related Post: