Credit Spreads Chart

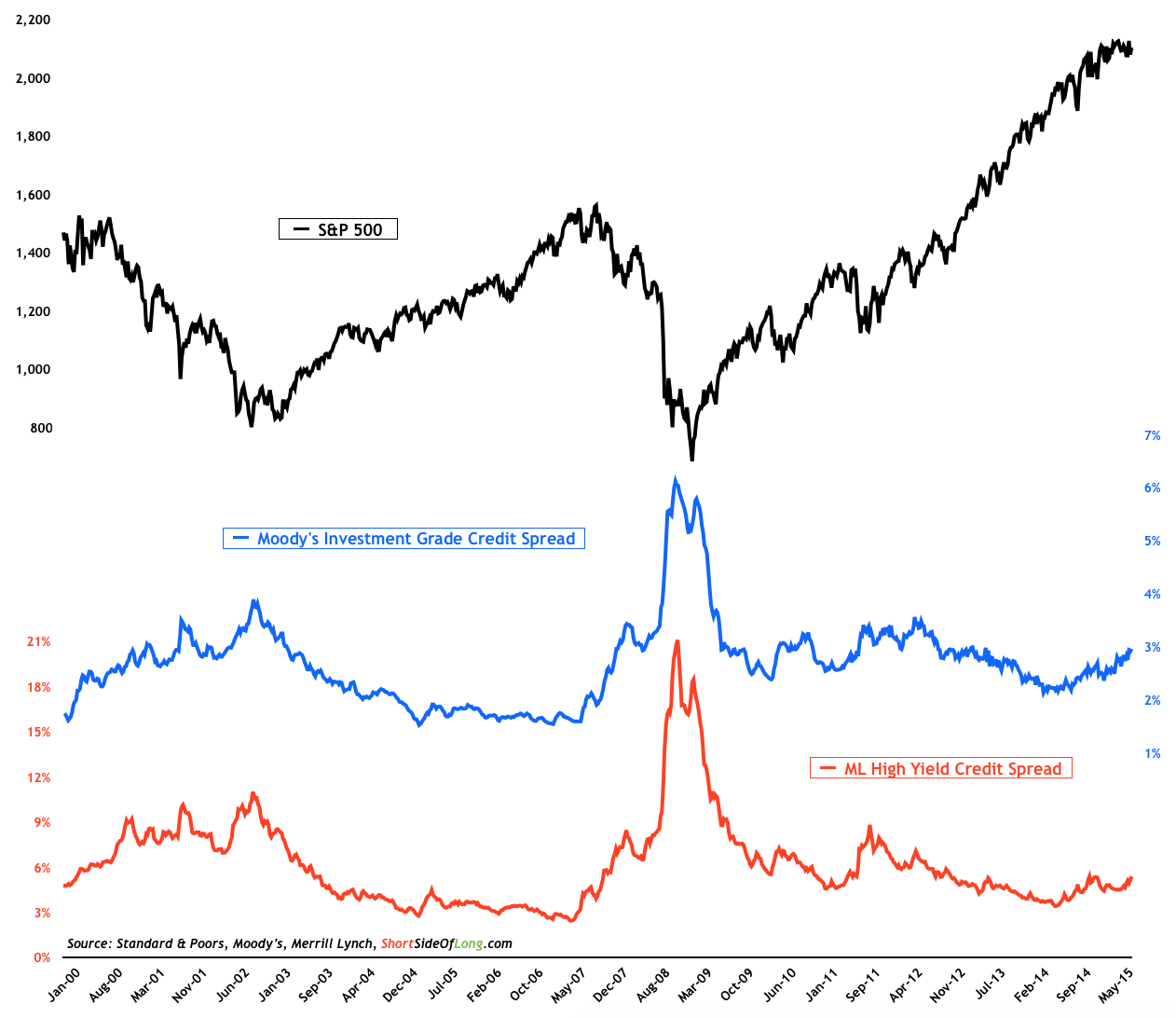

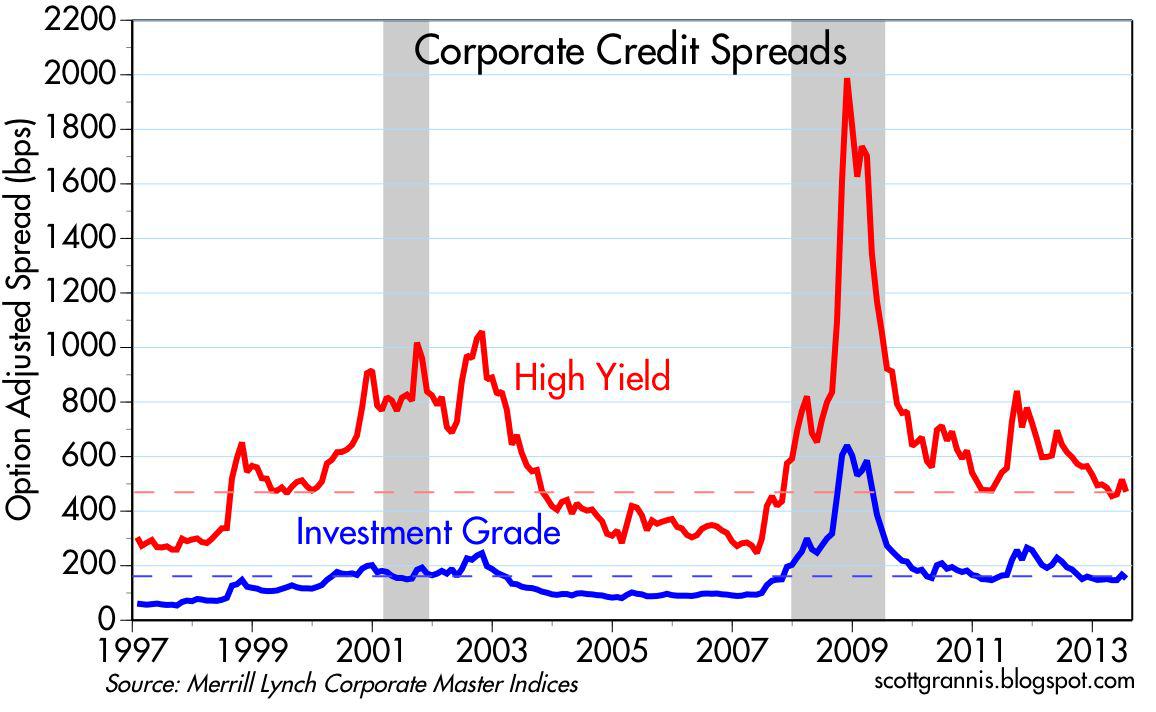

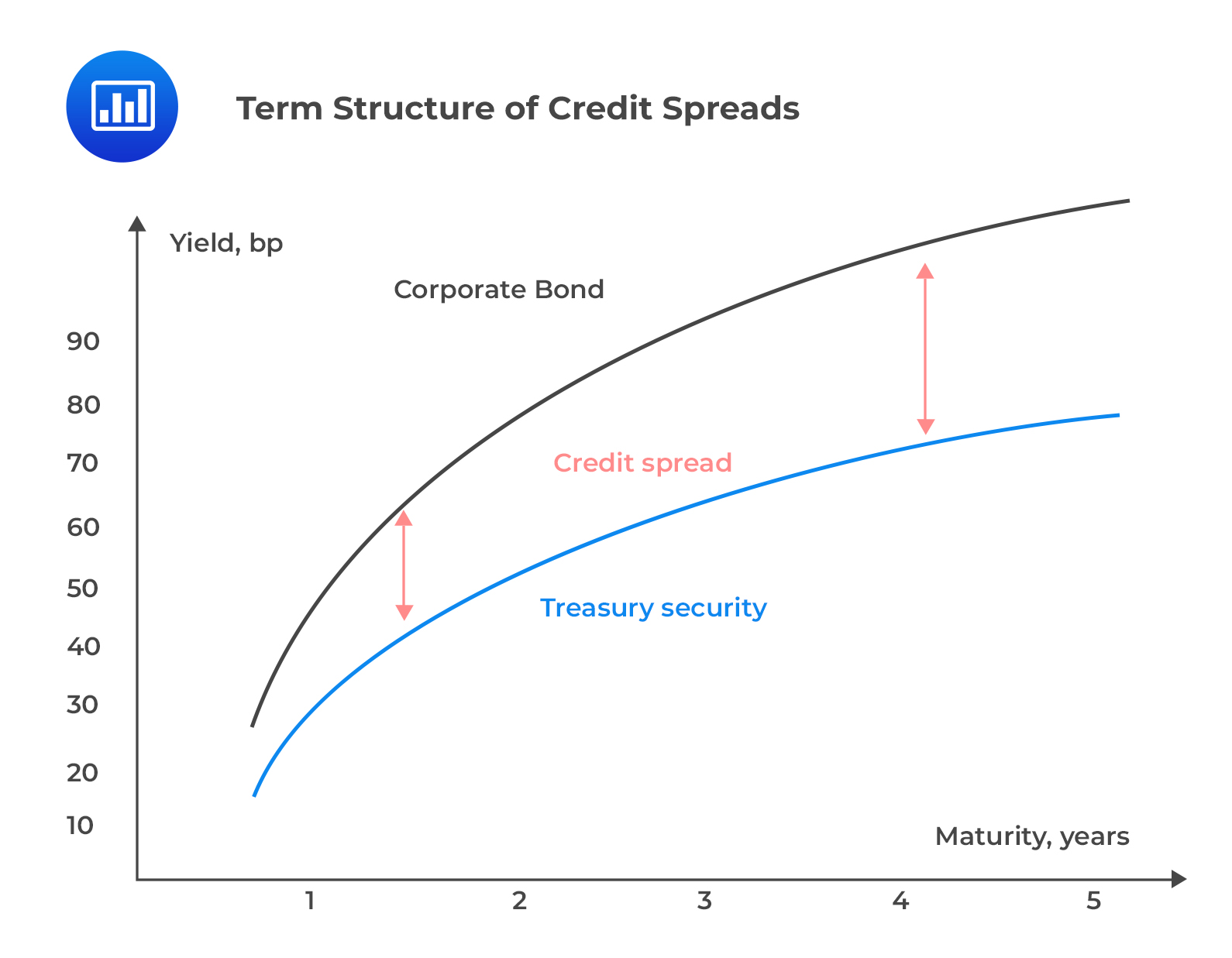

Credit Spreads Chart - This spread reflects the market's expectations of future corporate default risk. Intraday rsi risk off market closed credit spreads last updated jul 10 low credit stress high Interest rate spreads, 36 economic data series, fred: Live charts of yield curve spread indicators, including the 2s10s, 3m10s, 3m10y, 5s10s, 2s30s, 1s5s, 10s30s, and so on. Visually compare against similar indicators, plot min/max/average, compute correlations. Compare current bond market metrics, including which areas of the bond market offer the most attractive yields or whether corporate spreads are wider or narrower than average. Macromicro is changing the way people invest by providing. Download, graph, and track economic data. All bonds in this comparison have long durations, making the main differentiator the underlying. We believe that no investment decision should be taken without the consideration of economic fundamentals. We believe that no investment decision should be taken without the consideration of economic fundamentals. This interactive chart tracks the daily ted spread (3 month libor / 3 month treasury bill) as a measure of the perceived credit risk in the u.s. View data of the spreads between a computed index of all bonds below investment grade and a spot treasury curve. These charts display the yield spreads between corporate bonds, treasury bonds, and mortgages. Interest rate spreads, 36 economic data series, fred: This spread reflects the market's expectations of future corporate default risk. Live charts of yield curve spread indicators, including the 2s10s, 3m10s, 3m10y, 5s10s, 2s30s, 1s5s, 10s30s, and so on. Visually compare against similar indicators, plot min/max/average, compute correlations. Macromicro is changing the way people invest by providing. All bonds in this comparison have long durations, making the main differentiator the underlying. This spread reflects the market's expectations of future corporate default risk. Visually compare against similar indicators, plot min/max/average, compute correlations. Intraday rsi risk off market closed credit spreads last updated jul 10 low credit stress high These charts display the yield spreads between corporate bonds, treasury bonds, and mortgages. Interest rate spreads, 36 economic data series, fred: Macromicro is changing the way people invest by providing. This interactive chart tracks the daily ted spread (3 month libor / 3 month treasury bill) as a measure of the perceived credit risk in the u.s. Compare current bond market metrics, including which areas of the bond market offer the most attractive yields or whether corporate spreads are wider or. We believe that no investment decision should be taken without the consideration of economic fundamentals. Compare current bond market metrics, including which areas of the bond market offer the most attractive yields or whether corporate spreads are wider or narrower than average. All bonds in this comparison have long durations, making the main differentiator the underlying. This interactive chart tracks. This spread reflects the market's expectations of future corporate default risk. Interest rate spreads, 36 economic data series, fred: Intraday rsi risk off market closed credit spreads last updated jul 10 low credit stress high View data of the spreads between a computed index of all bonds below investment grade and a spot treasury curve. Visually compare against similar indicators,. This interactive chart tracks the daily ted spread (3 month libor / 3 month treasury bill) as a measure of the perceived credit risk in the u.s. All bonds in this comparison have long durations, making the main differentiator the underlying. We believe that no investment decision should be taken without the consideration of economic fundamentals. This spread reflects the. Live charts of yield curve spread indicators, including the 2s10s, 3m10s, 3m10y, 5s10s, 2s30s, 1s5s, 10s30s, and so on. These charts display the yield spreads between corporate bonds, treasury bonds, and mortgages. Macromicro is changing the way people invest by providing. This spread reflects the market's expectations of future corporate default risk. Interest rate spreads, 36 economic data series, fred: Download, graph, and track economic data. Intraday rsi risk off market closed credit spreads last updated jul 10 low credit stress high Visually compare against similar indicators, plot min/max/average, compute correlations. Interest rate spreads, 36 economic data series, fred: These charts display the yield spreads between corporate bonds, treasury bonds, and mortgages. Compare current bond market metrics, including which areas of the bond market offer the most attractive yields or whether corporate spreads are wider or narrower than average. Interest rate spreads, 36 economic data series, fred: Intraday rsi risk off market closed credit spreads last updated jul 10 low credit stress high We believe that no investment decision should be taken. Macromicro is changing the way people invest by providing. Intraday rsi risk off market closed credit spreads last updated jul 10 low credit stress high Live charts of yield curve spread indicators, including the 2s10s, 3m10s, 3m10y, 5s10s, 2s30s, 1s5s, 10s30s, and so on. These charts display the yield spreads between corporate bonds, treasury bonds, and mortgages. View data of. Download, graph, and track economic data. These charts display the yield spreads between corporate bonds, treasury bonds, and mortgages. Interest rate spreads, 36 economic data series, fred: Live charts of yield curve spread indicators, including the 2s10s, 3m10s, 3m10y, 5s10s, 2s30s, 1s5s, 10s30s, and so on. This interactive chart tracks the daily ted spread (3 month libor / 3 month. We believe that no investment decision should be taken without the consideration of economic fundamentals. Download, graph, and track economic data. Intraday rsi risk off market closed credit spreads last updated jul 10 low credit stress high Live charts of yield curve spread indicators, including the 2s10s, 3m10s, 3m10y, 5s10s, 2s30s, 1s5s, 10s30s, and so on. Macromicro is changing the way people invest by providing. All bonds in this comparison have long durations, making the main differentiator the underlying. Compare current bond market metrics, including which areas of the bond market offer the most attractive yields or whether corporate spreads are wider or narrower than average. This spread reflects the market's expectations of future corporate default risk. These charts display the yield spreads between corporate bonds, treasury bonds, and mortgages. Visually compare against similar indicators, plot min/max/average, compute correlations.Credit Spreads Continue To Rise Seeking Alpha

Credit Spread Update Still Looking Good Seeking Alpha

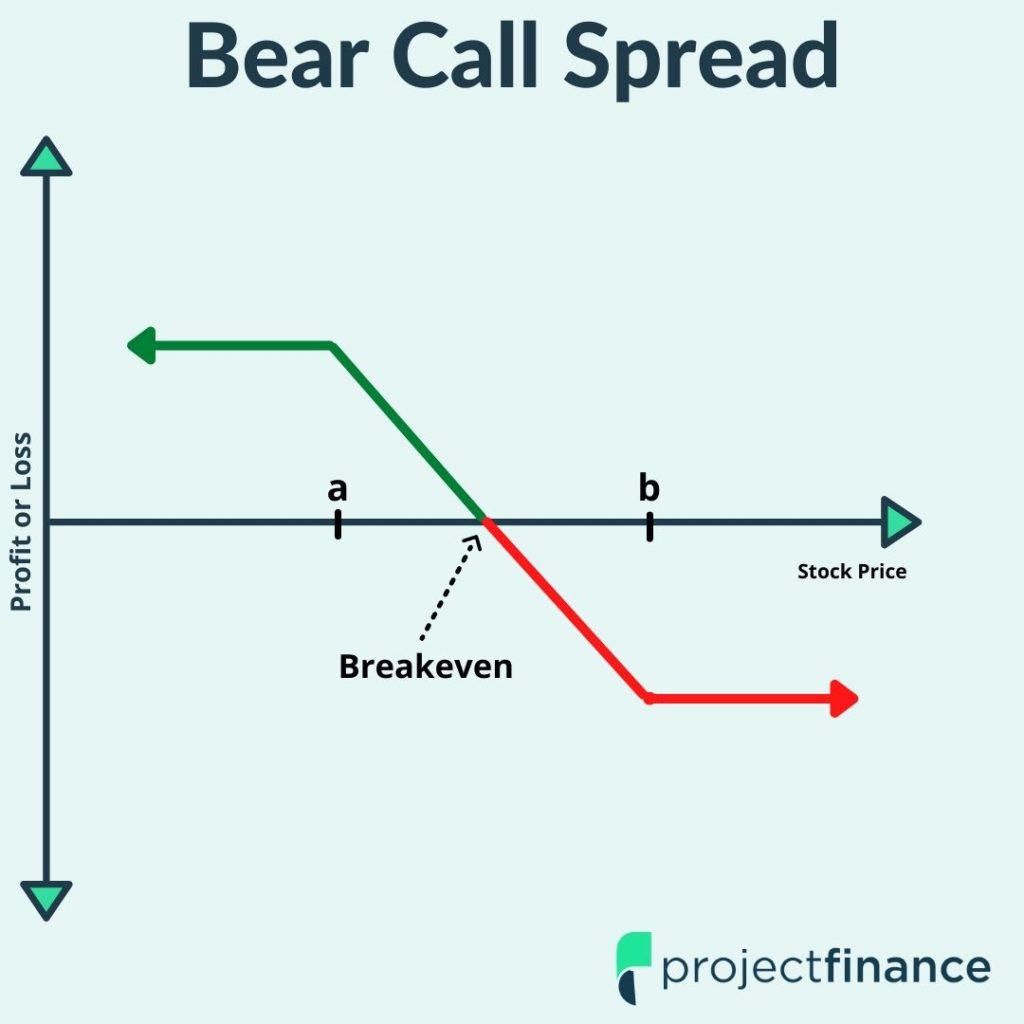

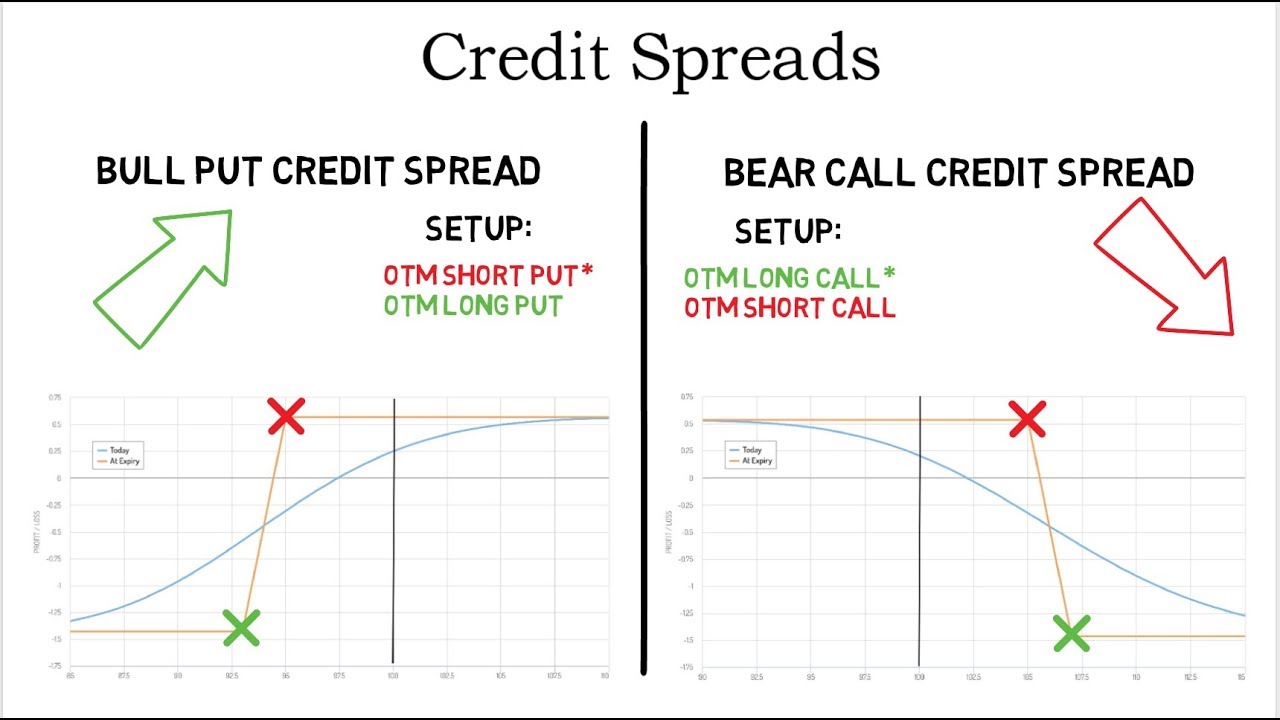

Credit Spread Options Strategies (Visuals and Examples)

Term Structure of Credit Spreads CFA, FRM, and Actuarial Exams Study Notes

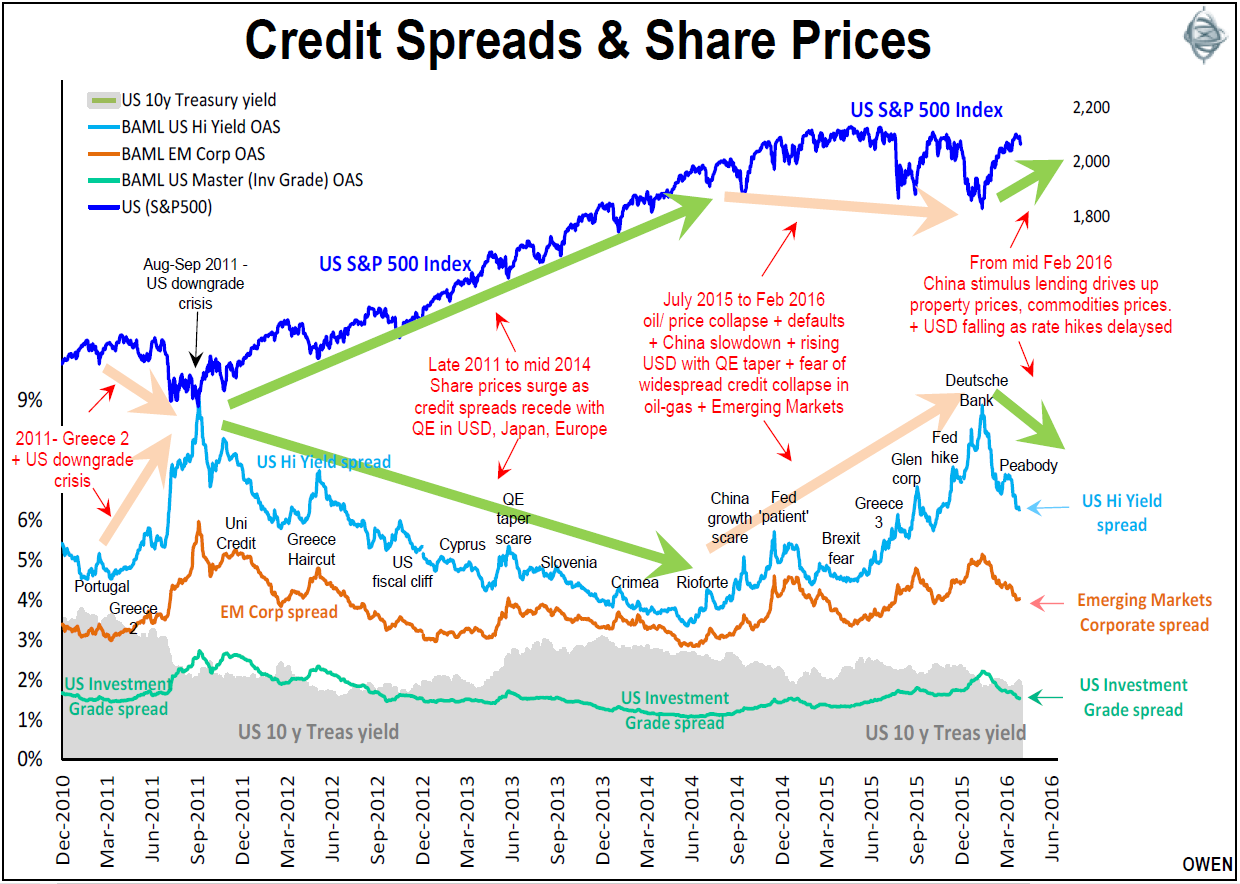

What credit spreads reveal about share markets

Credit Market Insights Global Rates on the Rise Morningstar

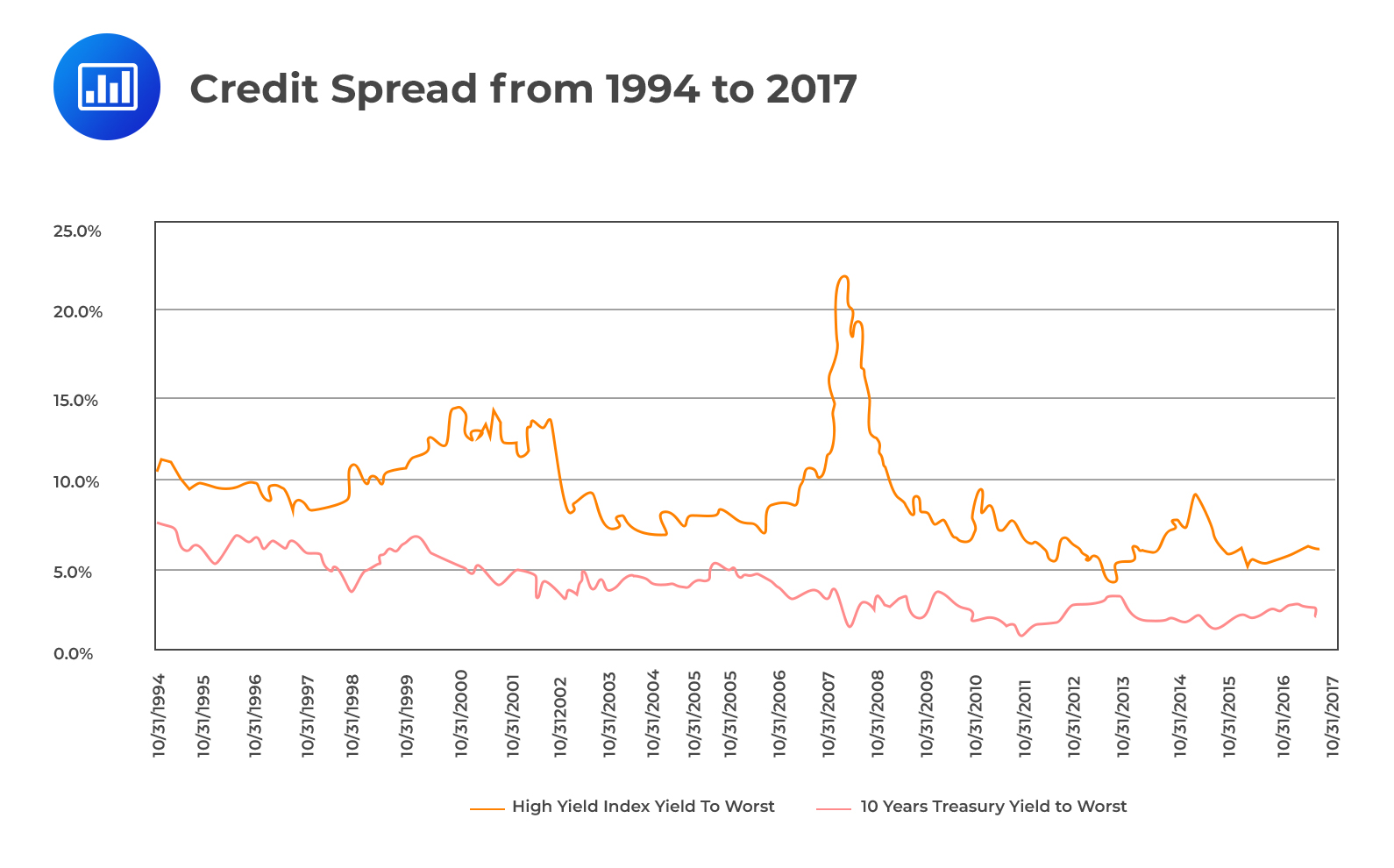

LongTerm Credit Spread Chart September 12, 2016

Options Series 1 Credit Spreads Knowmadic View

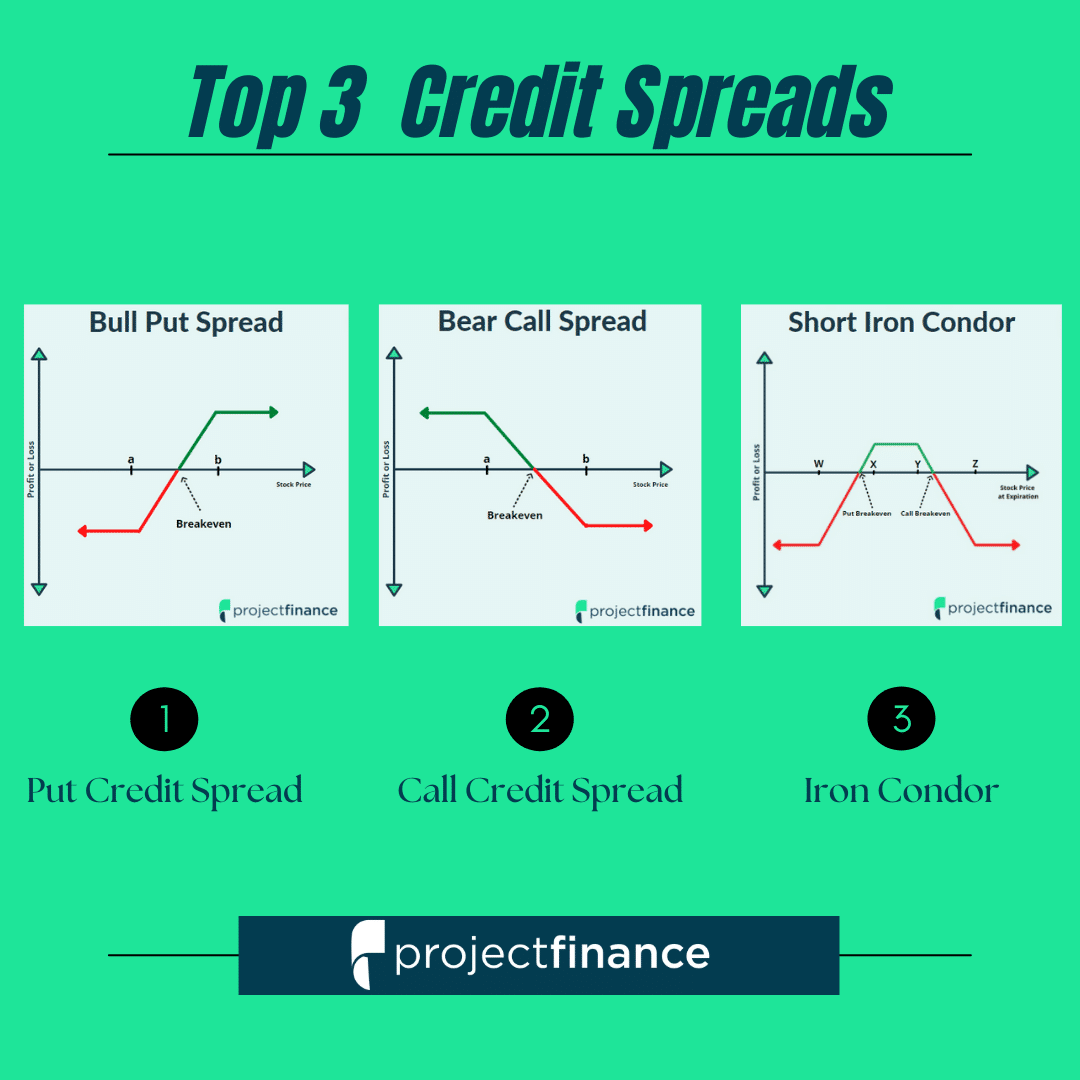

3 Best Credit Spread for Options Strategies projectfinance

Credit Spreads Explained Pdf at Jessica Bullard blog

This Interactive Chart Tracks The Daily Ted Spread (3 Month Libor / 3 Month Treasury Bill) As A Measure Of The Perceived Credit Risk In The U.s.

Interest Rate Spreads, 36 Economic Data Series, Fred:

View Data Of The Spreads Between A Computed Index Of All Bonds Below Investment Grade And A Spot Treasury Curve.

Related Post: