Apr Chart

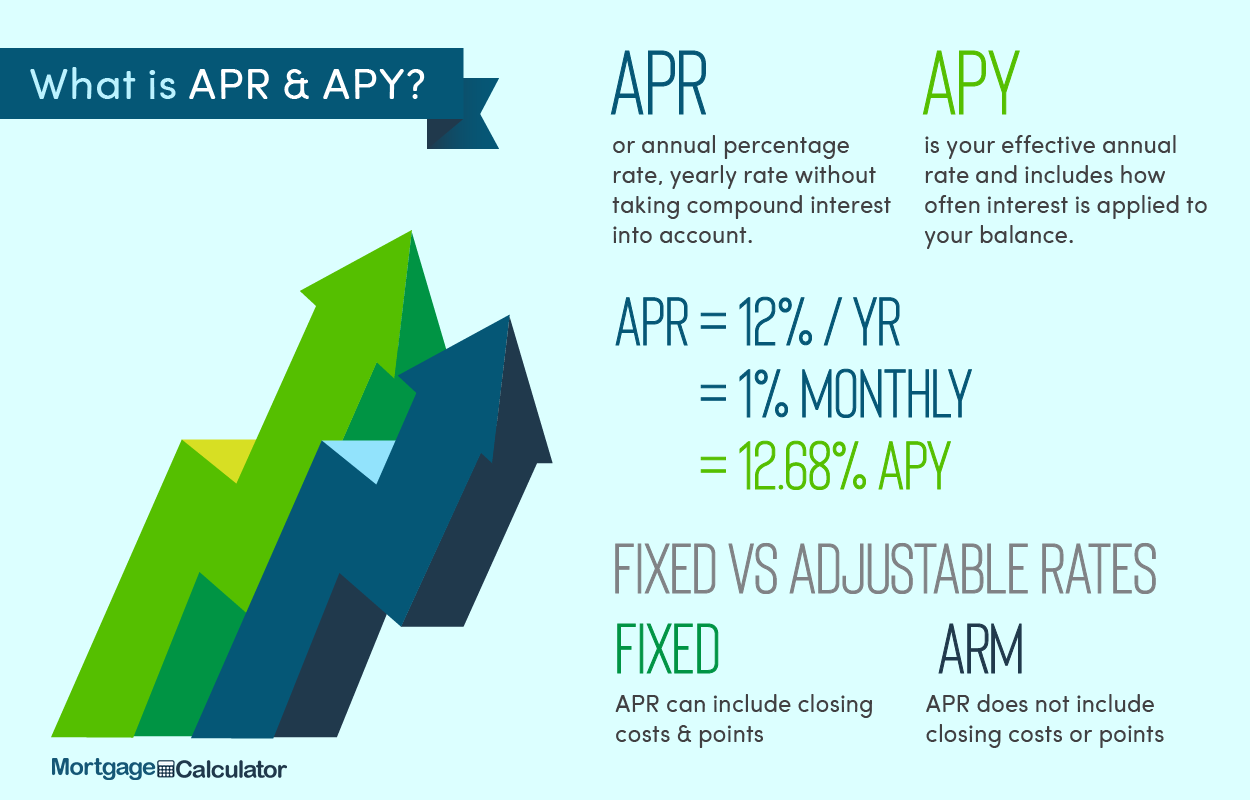

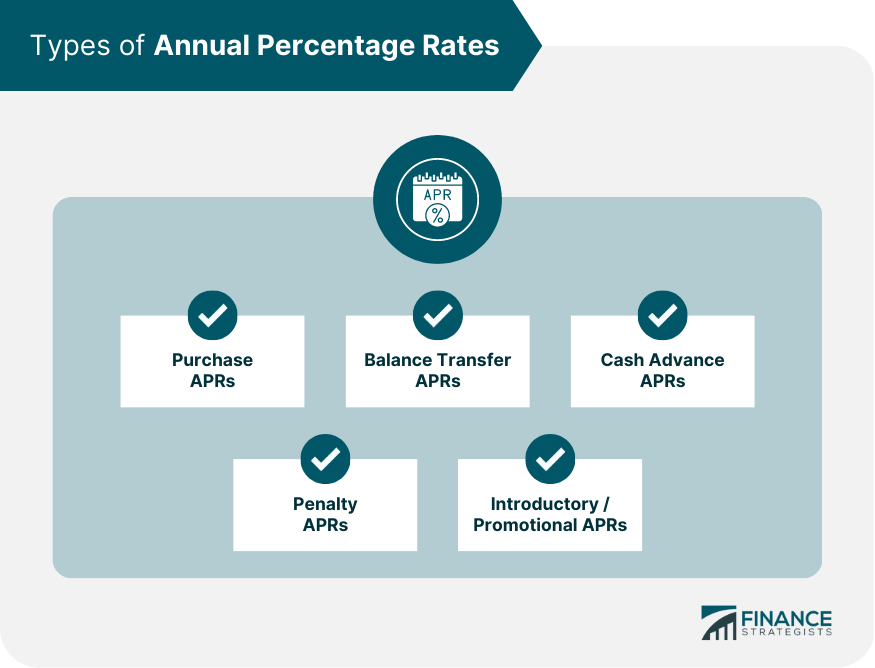

Apr Chart - What is the meaning of apr?. Apr reflects the total annual cost of a personal loan, including both fees and interest. It is typically used to compare different. Annual percentage rate (apr) is the rate of interest charged on borrowing or earned through investing, expressed as a yearly rate. Annual percentage rate (apr) is a number that represents the total cost of borrowing money from a lender. See how apr works on a mortgage and why it’s important. Many lenders state their apr online to make it easier to compare before you apply. Apr is a term that’s used when discussing credit products like credit cards, automobile loans, or mortgages, but what does annual percentage rate mean, exactly? The next time you take out a loan, you’ll feel empowered with the knowledge of the exact amount you’ll owe each month and the time remaining on your loan. As you shop around for financing, it's important to understand. As you shop around for financing, it's important to understand. Many lenders state their apr online to make it easier to compare before you apply. Apr is a term that’s used when discussing credit products like credit cards, automobile loans, or mortgages, but what does annual percentage rate mean, exactly? What is the meaning of apr?. Apr reflects the total annual cost of a personal loan, including both fees and interest. The next time you take out a loan, you’ll feel empowered with the knowledge of the exact amount you’ll owe each month and the time remaining on your loan. Annual percentage rate (apr) is a number that represents the total cost of borrowing money from a lender. Annual percentage rate (apr) is the rate your loan will accrue interest at over the repayment term. It is typically used to compare different. When you don't pay your credit card balance in full each month, your card issuer charges interest on your carried balance. See how apr works on a mortgage and why it’s important. The next time you take out a loan, you’ll feel empowered with the knowledge of the exact amount you’ll owe each month and the time remaining on your loan. When you don't pay your credit card balance in full each month, your card issuer charges interest on your carried. As you shop around for financing, it's important to understand. Annual percentage rate (apr) is the rate your loan will accrue interest at over the repayment term. Annual percentage rate (apr) is a number that represents the total cost of borrowing money from a lender. The next time you take out a loan, you’ll feel empowered with the knowledge of. Many lenders state their apr online to make it easier to compare before you apply. Apr reflects the total annual cost of a personal loan, including both fees and interest. See how apr works on a mortgage and why it’s important. It is typically used to compare different. Annual percentage rate (apr) is the interest charged for borrowing that represents. Apr and apy may differ by just one letter, but that small change can have a big impact on your financial future. Annual percentage rate (apr) is the rate your loan will accrue interest at over the repayment term. Apr reflects the total annual cost of a personal loan, including both fees and interest. The next time you take out. See how apr works on a mortgage and why it’s important. Annual percentage rate (apr) is a number that represents the total cost of borrowing money from a lender. The next time you take out a loan, you’ll feel empowered with the knowledge of the exact amount you’ll owe each month and the time remaining on your loan. As you. Annual percentage rate (apr) is a number that represents the total cost of borrowing money from a lender. Annual percentage rate (apr) is the rate your loan will accrue interest at over the repayment term. Apr is a term that’s used when discussing credit products like credit cards, automobile loans, or mortgages, but what does annual percentage rate mean, exactly?. Annual percentage rate (apr) is the rate of interest charged on borrowing or earned through investing, expressed as a yearly rate. What is the meaning of apr?. Annual percentage rate (apr) is the interest charged for borrowing that represents the actual yearly cost of the loan, including fees, expressed as a percentage. Annual percentage rate (apr) is a number that. As you shop around for financing, it's important to understand. It is typically used to compare different. Apr is a term that’s used when discussing credit products like credit cards, automobile loans, or mortgages, but what does annual percentage rate mean, exactly? Many lenders state their apr online to make it easier to compare before you apply. Annual percentage rate. When you don't pay your credit card balance in full each month, your card issuer charges interest on your carried balance. Annual percentage rate (apr) is a number that represents the total cost of borrowing money from a lender. Many lenders state their apr online to make it easier to compare before you apply. See how apr works on a. It is typically used to compare different. See how apr works on a mortgage and why it’s important. Annual percentage rate (apr) is the rate your loan will accrue interest at over the repayment term. Many lenders state their apr online to make it easier to compare before you apply. As you shop around for financing, it's important to understand. It is typically used to compare different. What is the meaning of apr?. Annual percentage rate (apr) is the interest charged for borrowing that represents the actual yearly cost of the loan, including fees, expressed as a percentage. Annual percentage rate (apr) is a number that represents the total cost of borrowing money from a lender. Annual percentage rate (apr) is the rate of interest charged on borrowing or earned through investing, expressed as a yearly rate. Many lenders state their apr online to make it easier to compare before you apply. Apr, or annual percentage rate, is a term that you’ve likely seen in various financial documents or heard during discussions about loans and credit cards. Apr and apy may differ by just one letter, but that small change can have a big impact on your financial future. As you shop around for financing, it's important to understand. Annual percentage rate (apr) is the rate your loan will accrue interest at over the repayment term. Apr is a term that’s used when discussing credit products like credit cards, automobile loans, or mortgages, but what does annual percentage rate mean, exactly? The next time you take out a loan, you’ll feel empowered with the knowledge of the exact amount you’ll owe each month and the time remaining on your loan.What is APR? Mortgage APR? MLS Mortgage

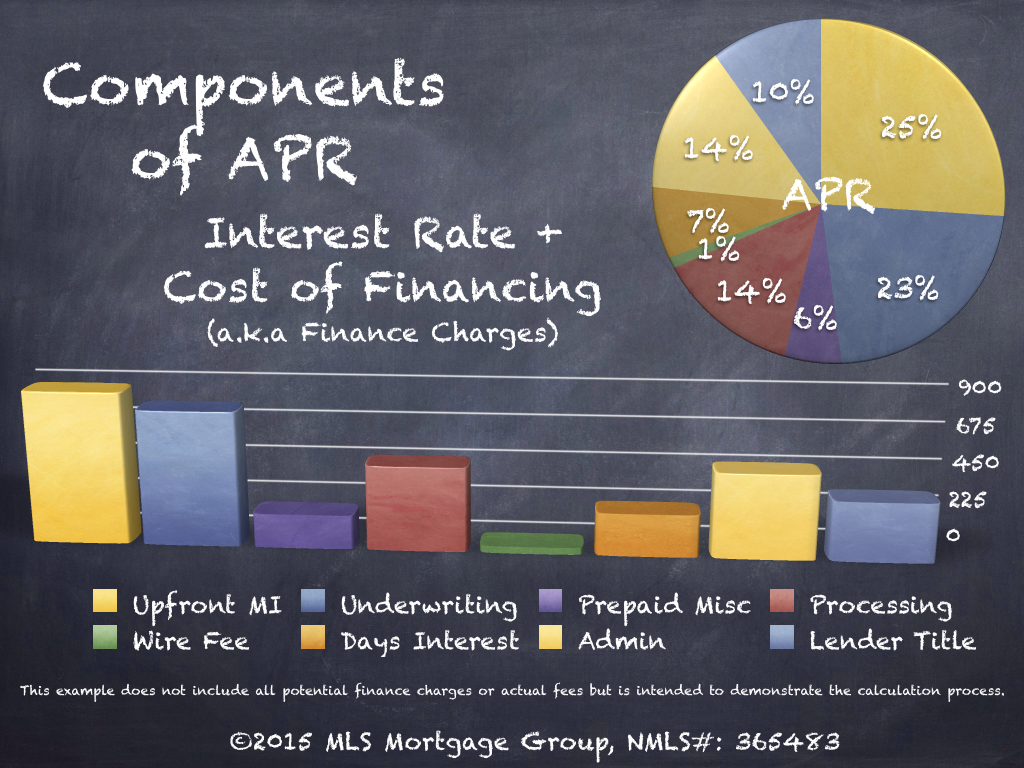

What is APR? Mortgage APR? MLS Mortgage

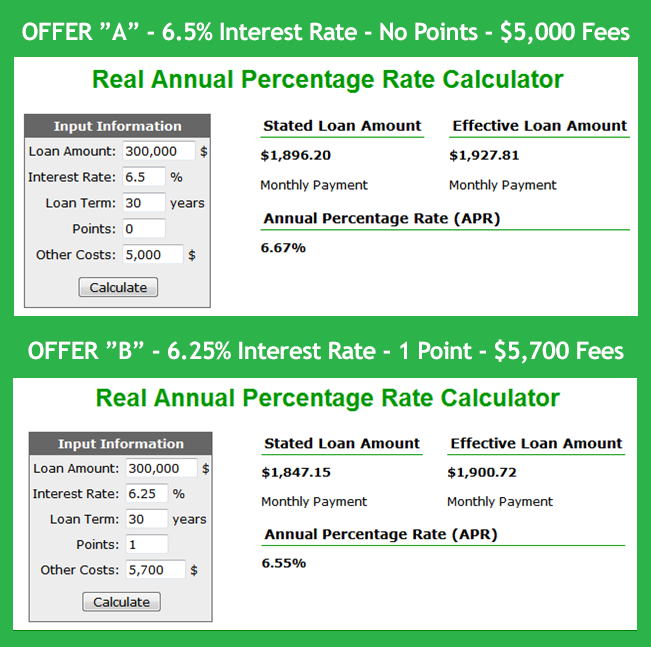

True Mortgage APR Calculator Actual Interest Rate Home Loan Calculator

Annual Percentage Rate (APR) Definition, Calculation, & Types

APR vs. Interest Rate Explained

Real APR Mortgage Calculator Calculate Actual Home Loan Annual Percentage Rate Interest Rates

What is APR? Mortgage APR? MLS Mortgage

What is APR? Mortgage APR? MLS Mortgage

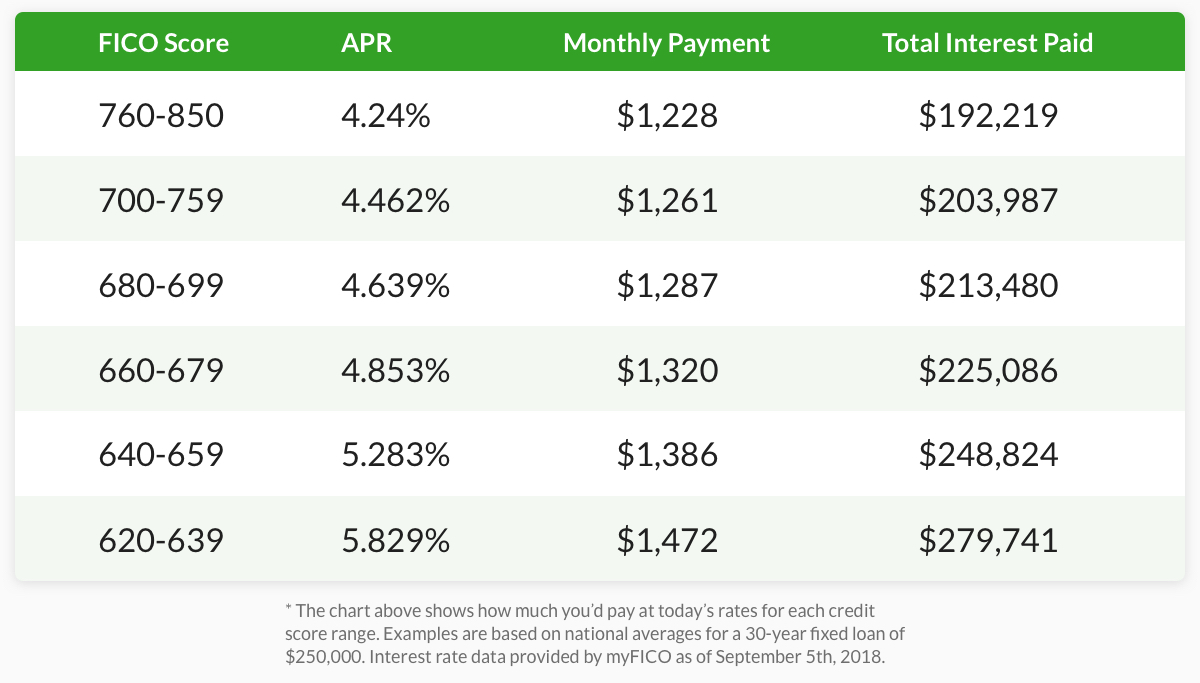

How Your Credit Score Determines Mortgage Interest Rates

How to Calculate APR in Excel (3 Simple Methods) ExcelDemy

See How Apr Works On A Mortgage And Why It’s Important.

When You Don't Pay Your Credit Card Balance In Full Each Month, Your Card Issuer Charges Interest On Your Carried Balance.

Apr Reflects The Total Annual Cost Of A Personal Loan, Including Both Fees And Interest.

Related Post: