Annuity Due Chart

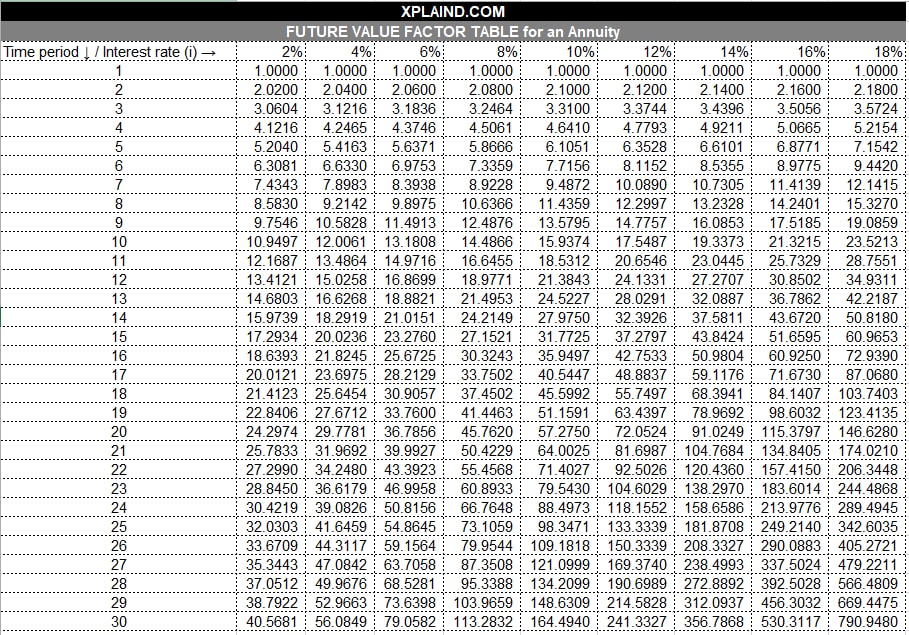

Annuity Due Chart - We'll help you grasp the basics of this guaranteed income stream. Learn how annuities work, explore different types, and discover how they can help you achieve retirement goals in this beginner's guide. An annuity is an insurance contract that exchanges present contributions for future income payments. Many also have investment components that can potentially increase. An annuity is a financial product that pays out a fixed and reliable stream of income to an individual, which is typically of primary importance to retirees. If annuities mystify you, here's a clear annuity definition and a glossary of key terms. At its most basic level, an annuity is a contract between you and an insurance company that shifts a portion of risk away from you and onto the company. Sold by financial services companies, annuities can help reinforce your. Annuities are insurance products designed to provide you with regular income—often for life. There are 2 basic types of annuities:. In investment, an annuity is a series of payments made at equal intervals based on a contract with a lump sum of money. An annuity is a contract between you and an insurance company to cover specific goals, such as principal protection, lifetime income, legacy planning. An annuity is a financial product that pays out a fixed and reliable stream of income to an individual, which is typically of primary importance to retirees. An annuity is a contract purchased from an insurance company with a large lump sum in return for regular payments, commonly used as an income source in retirement. We'll help you grasp the basics of this guaranteed income stream. If annuities mystify you, here's a clear annuity definition and a glossary of key terms. Learn how annuities work, explore different types, and discover how they can help you achieve retirement goals in this beginner's guide. At its most basic level, an annuity is a contract between you and an insurance company that shifts a portion of risk away from you and onto the company. Sold by financial services companies, annuities can help reinforce your. Insurance companies are common annuity providers and are used. Many also have investment components that can potentially increase. An annuity is a contract between you and an insurance company to cover specific goals, such as principal protection, lifetime income, legacy planning. Sold by financial services companies, annuities can help reinforce your. Learn how annuities work, explore different types, and discover how they can help you achieve retirement goals in. There are 2 basic types of annuities:. In investment, an annuity is a series of payments made at equal intervals based on a contract with a lump sum of money. Many also have investment components that can potentially increase. An annuity is a financial product that pays out a fixed and reliable stream of income to an individual, which is. An annuity is a contract purchased from an insurance company with a large lump sum in return for regular payments, commonly used as an income source in retirement. An annuity is an insurance contract that exchanges present contributions for future income payments. We'll help you grasp the basics of this guaranteed income stream. An annuity is a financial product that. An annuity is an insurance contract that exchanges present contributions for future income payments. At its most basic level, an annuity is a contract between you and an insurance company that shifts a portion of risk away from you and onto the company. Annuities are insurance products designed to provide you with regular income—often for life. There are 2 basic. An annuity is an insurance contract that exchanges present contributions for future income payments. Sold by financial services companies, annuities can help reinforce your. Annuities are insurance products designed to provide you with regular income—often for life. Insurance companies are common annuity providers and are used. If annuities mystify you, here's a clear annuity definition and a glossary of key. If annuities mystify you, here's a clear annuity definition and a glossary of key terms. An annuity is a contract purchased from an insurance company with a large lump sum in return for regular payments, commonly used as an income source in retirement. Many also have investment components that can potentially increase. Learn how annuities work, explore different types, and. We'll help you grasp the basics of this guaranteed income stream. An annuity is a contract between you and an insurance company to cover specific goals, such as principal protection, lifetime income, legacy planning. An annuity is a financial product that pays out a fixed and reliable stream of income to an individual, which is typically of primary importance to. There are 2 basic types of annuities:. We'll help you grasp the basics of this guaranteed income stream. An annuity is a financial product that pays out a fixed and reliable stream of income to an individual, which is typically of primary importance to retirees. If annuities mystify you, here's a clear annuity definition and a glossary of key terms.. Learn how annuities work, explore different types, and discover how they can help you achieve retirement goals in this beginner's guide. If annuities mystify you, here's a clear annuity definition and a glossary of key terms. There are 2 basic types of annuities:. Many also have investment components that can potentially increase. Sold by financial services companies, annuities can help. An annuity is a contract purchased from an insurance company with a large lump sum in return for regular payments, commonly used as an income source in retirement. There are 2 basic types of annuities:. Insurance companies are common annuity providers and are used. Sold by financial services companies, annuities can help reinforce your. Learn how annuities work, explore different. An annuity is a contract between you and an insurance company to cover specific goals, such as principal protection, lifetime income, legacy planning. Learn how annuities work, explore different types, and discover how they can help you achieve retirement goals in this beginner's guide. Insurance companies are common annuity providers and are used. There are 2 basic types of annuities:. If annuities mystify you, here's a clear annuity definition and a glossary of key terms. An annuity is a financial product that pays out a fixed and reliable stream of income to an individual, which is typically of primary importance to retirees. Annuities are insurance products designed to provide you with regular income—often for life. An annuity is an insurance contract that exchanges present contributions for future income payments. Sold by financial services companies, annuities can help reinforce your. At its most basic level, an annuity is a contract between you and an insurance company that shifts a portion of risk away from you and onto the company. In investment, an annuity is a series of payments made at equal intervals based on a contract with a lump sum of money.Future Value Annuity

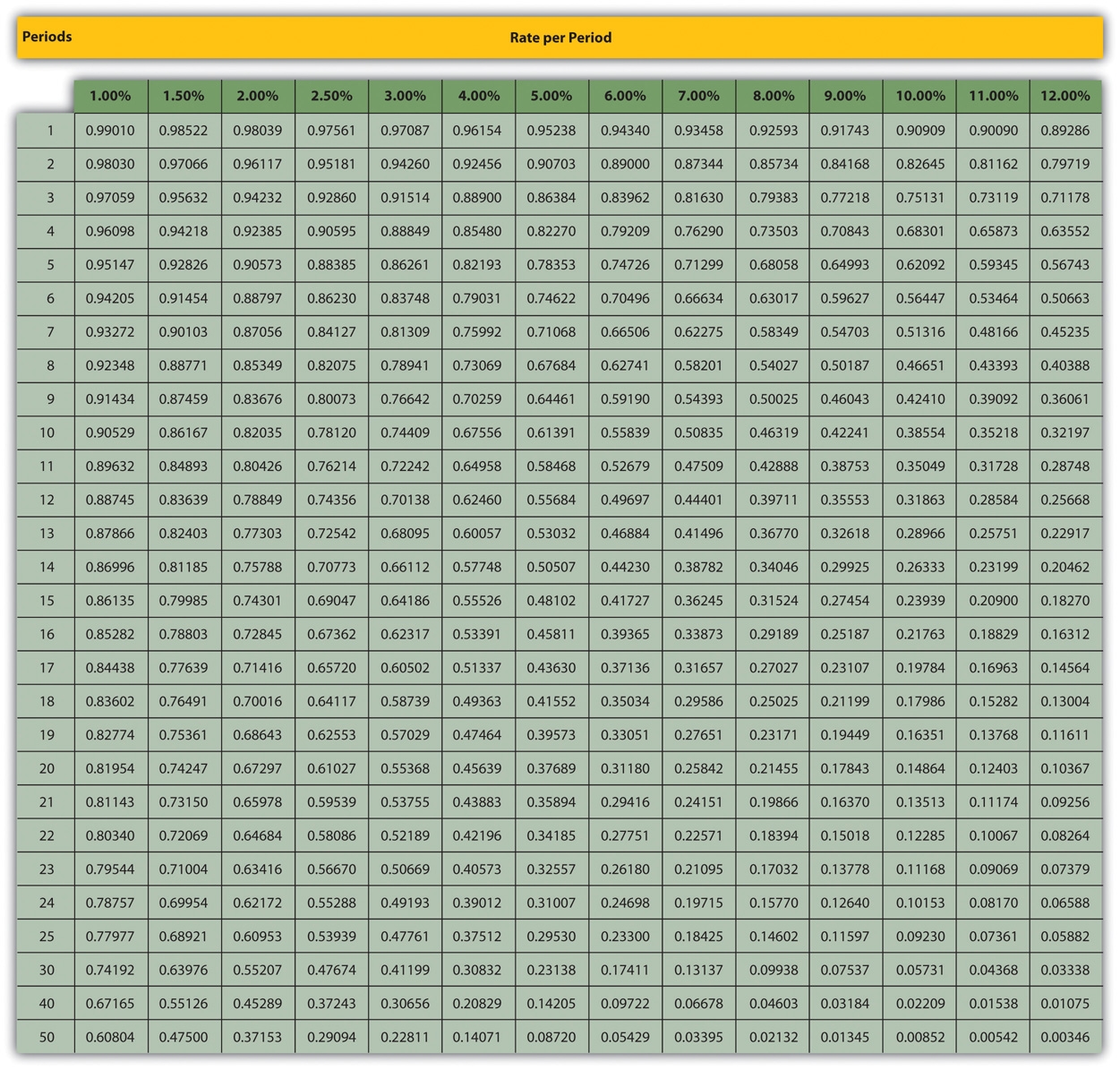

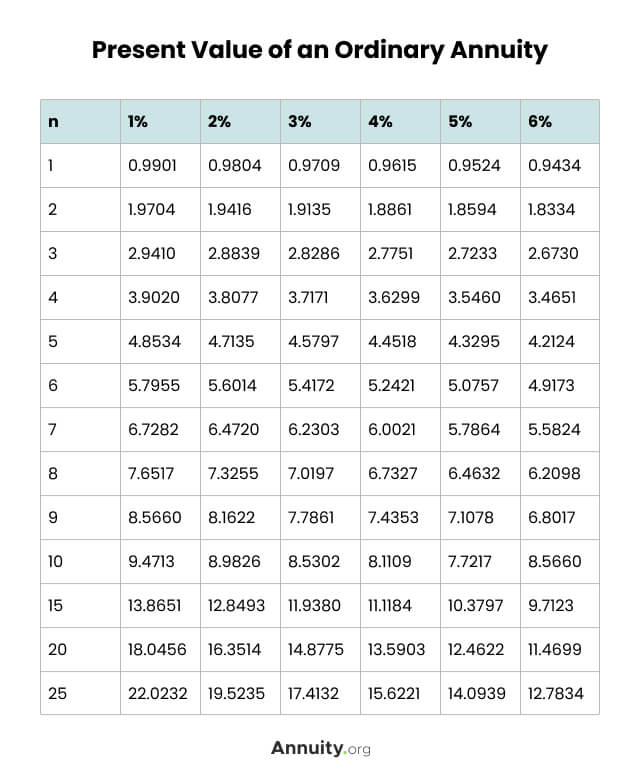

8 Photos Present Value Of Ordinary Annuity Due Table And View Alqu Blog

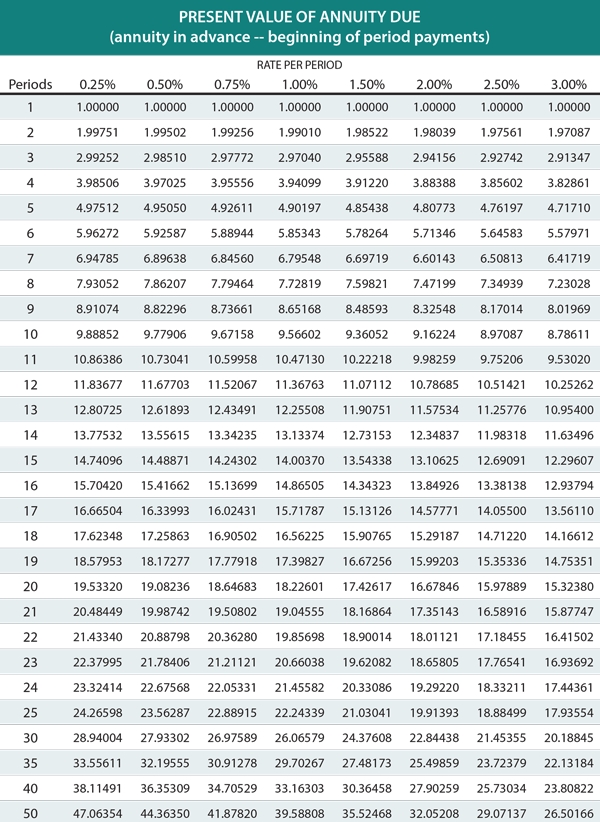

Present Value Of Annuity Due Table 7 Matttroy

Present Value Of Annuity Due Table 7 Matttroy

What Is Annuity Calculator at Richard Avitia blog

8 Pics Pv Of Annuity Due Table And Description Alqu Blog

What Is the Present Value of Annuity? Business Accounting

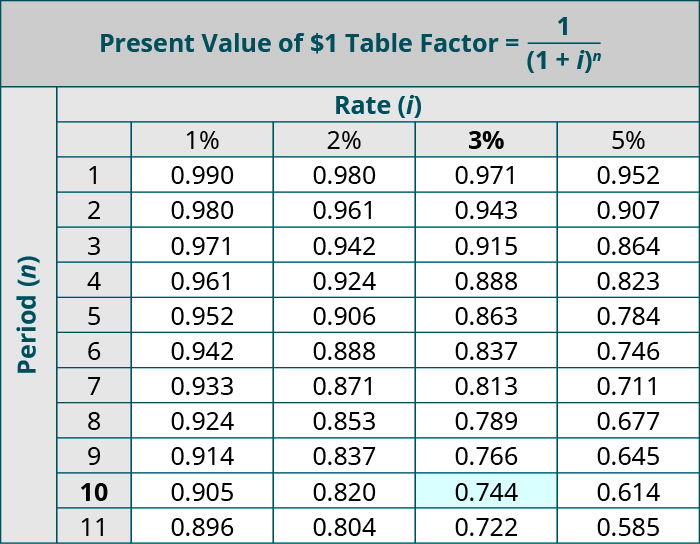

Present Value Annuity Due Tables Double Entry Bookkeeping

Pv Of Annuity Due Table Elcho Table

Pv Ordinary Annuity Due Table

An Annuity Is A Contract Purchased From An Insurance Company With A Large Lump Sum In Return For Regular Payments, Commonly Used As An Income Source In Retirement.

We'll Help You Grasp The Basics Of This Guaranteed Income Stream.

Many Also Have Investment Components That Can Potentially Increase.

Related Post:

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities2-9c9db03774fd45fc83501879e123f82d.png)