409A Pt Chart

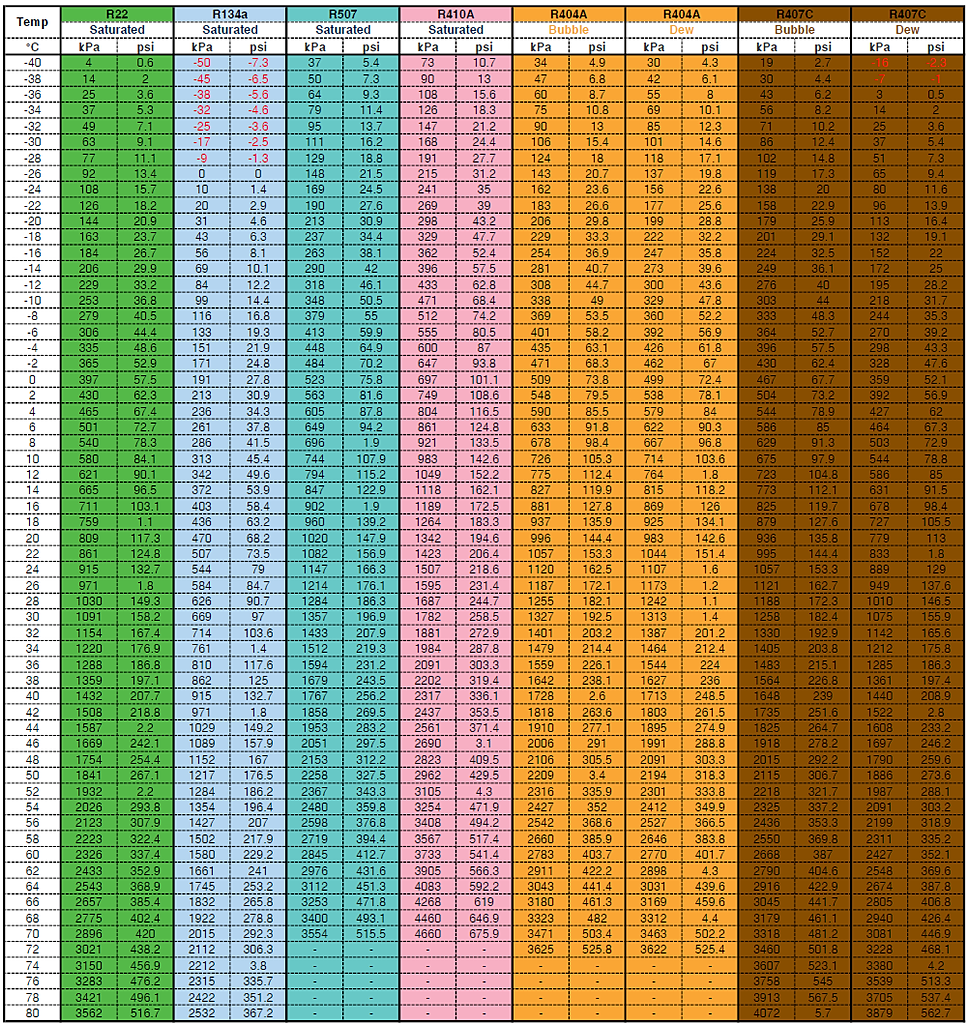

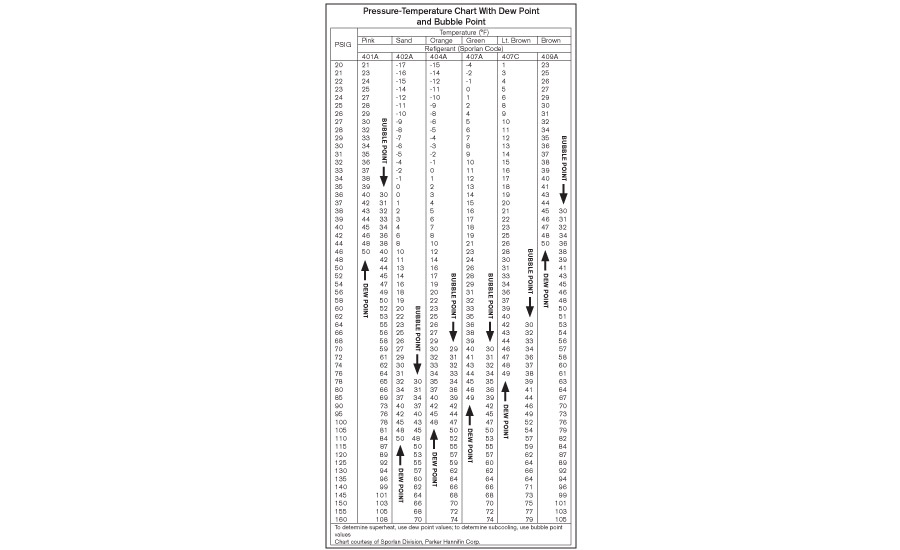

409A Pt Chart - It determines the price of stock options offered to employees—and the irs requires it. If a principal purpose of a plan is to achieve a result with respect to a deferral of compensation that is inconsistent with the purposes of section 409a, the commissioner may treat the plan as. Section 409a provides a broad definition of nonqualified deferred compensation and provides rules related to the timing of elections and distributions under deferred compensation. If you are incredibly detail oriented, you can read the complete, final irs. Irc section 409a deferred compensation compliance requirements represent one of the most complex and consequential areas of modern tax law that i encounter in my practice. This plan is often used by high. All compensation deferred under the plan for the taxable year and all preceding taxable years shall be includible in gross income for the taxable year to the extent not subject to a. Section 409a of the internal revenue code governs nonqualified deferred compensation plans, impacting employers and employees. Section 409a of the internal revenue code (irc) is a federal law governing nonqualified deferred compensation (nqdc) plans. To curtail this abuse, sec. 409a places restrictions on the deferral of compensation under nonqualified deferred compensation plans (including underlying agreements or any. Section 409a of the united states internal revenue code regulates nonqualified deferred compensation paid by a service recipient to a service provider by generally imposing a 20%. If a principal purpose of a plan is to achieve a result with respect to a deferral of compensation that is inconsistent with the purposes of section 409a, the commissioner may treat the plan as. Inclusion in gross income of deferred compensation under nonqualified deferred compensation plans text contains those laws in effect on january 7, 2011 The internal revenue code that deals with nqdc plans is section 409a. Enacted in 2004, it aims to ensure that. Section 409a of the internal revenue code governs nonqualified deferred compensation plans, impacting employers and employees. Learn more in our guide. This tax code was enacted in 2004 to help regulate the way deferred compensation is structured, reported, and. Discover tax implications and compliance strategies. Learn more in our guide. 409a places restrictions on the deferral of compensation under nonqualified deferred compensation plans (including underlying agreements or any. Your nonqualified plan must adhere to section 409a regulations to provide the necessary benefits to your employees. To curtail this abuse, sec. If you are incredibly detail oriented, you can read the complete, final irs. Section 409a of the united states internal revenue code regulates nonqualified deferred compensation paid by a service recipient to a service provider by generally imposing a 20%. Inclusion in gross income of deferred compensation under nonqualified deferred compensation plans text contains those laws in effect on january 7, 2011 To curtail this abuse, sec. Your nonqualified plan must adhere to. If a principal purpose of a plan is to achieve a result with respect to a deferral of compensation that is inconsistent with the purposes of section 409a, the commissioner may treat the plan as. Learn about 409a plans, including the definition, compensation types, requirements, and exemptions. Section 409a of the united states internal revenue code regulates nonqualified deferred compensation. Its rules aim to prevent improper. If you are incredibly detail oriented, you can read the complete, final irs. Section 409a provides a broad definition of nonqualified deferred compensation and provides rules related to the timing of elections and distributions under deferred compensation. Irc section 409a deferred compensation compliance requirements represent one of the most complex and consequential areas of. Section 409a of the internal revenue code (irc) is a federal law governing nonqualified deferred compensation (nqdc) plans. Section 409a of the united states internal revenue code regulates nonqualified deferred compensation paid by a service recipient to a service provider by generally imposing a 20%. Inclusion in gross income of deferred compensation under nonqualified deferred compensation plans text contains those. Your nonqualified plan must adhere to section 409a regulations to provide the necessary benefits to your employees. Learn more in our guide. Learn about 409a plans, including the definition, compensation types, requirements, and exemptions. Section 409a of the internal revenue code (irc) is a federal law governing nonqualified deferred compensation (nqdc) plans. To curtail this abuse, sec. All compensation deferred under the plan for the taxable year and all preceding taxable years shall be includible in gross income for the taxable year to the extent not subject to a. This plan is often used by high. Section 409a of the united states internal revenue code regulates nonqualified deferred compensation paid by a service recipient to a service. If a principal purpose of a plan is to achieve a result with respect to a deferral of compensation that is inconsistent with the purposes of section 409a, the commissioner may treat the plan as. Discover tax implications and compliance strategies. The internal revenue code that deals with nqdc plans is section 409a. The 409a plan, which is governed by. This plan is often used by high. Section 409a of the internal revenue code governs nonqualified deferred compensation plans, impacting employers and employees. The 409a plan, which is governed by the. Inclusion in gross income of deferred compensation under nonqualified deferred compensation plans text contains those laws in effect on january 7, 2011 If a principal purpose of a plan. If a principal purpose of a plan is to achieve a result with respect to a deferral of compensation that is inconsistent with the purposes of section 409a, the commissioner may treat the plan as. This plan is often used by high. Discover tax implications and compliance strategies. Learn about 409a plans, including the definition, compensation types, requirements, and exemptions.. 409a places restrictions on the deferral of compensation under nonqualified deferred compensation plans (including underlying agreements or any. Discover tax implications and compliance strategies. Your nonqualified plan must adhere to section 409a regulations to provide the necessary benefits to your employees. Internal revenue code § 409a. Section 409a of the united states internal revenue code regulates nonqualified deferred compensation paid by a service recipient to a service provider by generally imposing a 20%. This tax code was enacted in 2004 to help regulate the way deferred compensation is structured, reported, and. It determines the price of stock options offered to employees—and the irs requires it. Its rules aim to prevent improper. Learn more in our guide. Irc section 409a deferred compensation compliance requirements represent one of the most complex and consequential areas of modern tax law that i encounter in my practice. Learn about 409a plans, including the definition, compensation types, requirements, and exemptions. This plan is often used by high. The 409a plan, which is governed by the. Internal revenue code section 409a regulates nonqualified deferred compensation (nqdc) plans and arrangements, which are commonly used to provide. Section 409a of the internal revenue code governs nonqualified deferred compensation plans, impacting employers and employees. Inclusion in gross income of deferred compensation under nonqualified deferred compensation plans text contains those laws in effect on january 7, 2011R134a Refrigerant Pressure Temperature Sample Chart Free Download

407C PT Charts Download Printable Free

Pressure and Temperature Chart Free Download

Pressure Temperature Chart 410a Refrigerant

409a Refrigerant Pressure Chart Minga

409a Refrigerant Pressure Temperature Chart Ponasa

Temperature Pressure Chart For R410a

R134a Pressure Temperature Chart Free Download

409a Refrigerant Pressure Chart Ponasa

Refrigerant Pressure Temperature Chart

Section 409A Of The Internal Revenue Code (Irc) Is A Federal Law Governing Nonqualified Deferred Compensation (Nqdc) Plans.

If A Principal Purpose Of A Plan Is To Achieve A Result With Respect To A Deferral Of Compensation That Is Inconsistent With The Purposes Of Section 409A, The Commissioner May Treat The Plan As.

To Curtail This Abuse, Sec.

The Internal Revenue Code That Deals With Nqdc Plans Is Section 409A.

Related Post: